Insurance Third Party Administrators Market by Type & Service 2025

Insurance Third Party Administrators Market Size & Forecast (2025–2033)

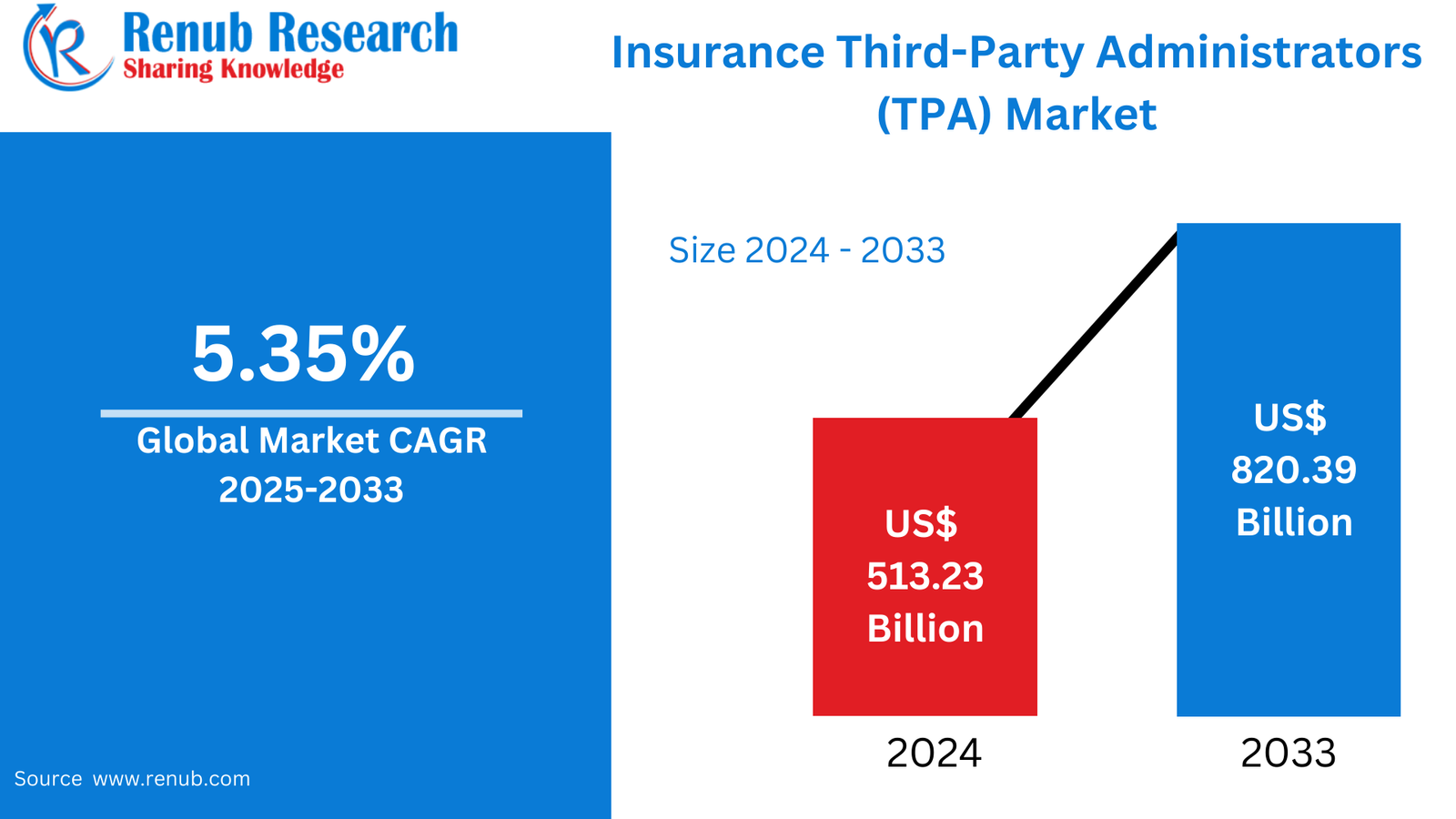

According To Renub Research Insurance Third Party Administrators (TPA) market is witnessing sustained expansion as insurers across the globe increasingly rely on specialized service providers to manage complex administrative functions. In 2024, the market was valued at approximately US$ 513.23 billion and is projected to reach US$ 820.39 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.35% from 2025 to 2033. This steady growth trajectory is driven by rising insurance penetration, increasing claim volumes, escalating healthcare costs, and the growing need for efficient, transparent, and technology-enabled policy administration.

Third Party Administrators act as critical intermediaries between insurers, policyholders, healthcare providers, repair networks, and regulatory authorities. By managing operationally intensive tasks, TPAs enable insurance companies to improve service delivery, reduce overhead costs, and focus on core competencies such as product innovation, underwriting, and market expansion.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=insurance-third-party-administrators-market-p.php

Insurance Third Party Administrators Market Outlook

Insurance Third Party Administrators are professional service organizations that manage administrative and operational insurance processes on behalf of insurance carriers and self-insured entities. Their responsibilities typically include claims processing, policy servicing, customer support, premium administration, compliance reporting, fraud detection, and coordination with service providers such as hospitals, garages, and surveyors.

The complexity of modern insurance products, combined with regulatory scrutiny and customer expectations for faster claim settlements, has significantly increased dependence on TPAs. As insurance ecosystems become more data-driven and customer-centric, TPAs play a vital role in ensuring accuracy, compliance, and operational efficiency throughout the insurance lifecycle.

Globally, demand for TPAs is particularly strong in countries with mature health, motor, and life insurance sectors. Markets such as North America, Europe, and parts of Asia-Pacific are witnessing rapid adoption due to rising claim frequency, digitization initiatives, and the growing need for scalable administrative support.

Key Growth Drivers in the Insurance Third Party Administrators Market

Rising Demand for Efficient Claims Management

The continuous increase in insurance claims across health, motor, commercial, and workers’ compensation segments is a major growth driver for the TPA market. Managing high claim volumes internally can be costly and time-consuming for insurers. TPAs streamline the claims lifecycle by ensuring accurate documentation, timely verification, efficient settlement, and transparent communication with policyholders.

Faster claim resolution improves customer satisfaction while reducing operational bottlenecks for insurers. As customer expectations continue to rise, insurers are increasingly partnering with TPAs to maintain service quality and brand reputation.

Growing Outsourcing of Insurance Administrative Services

Insurance companies are increasingly outsourcing non-core functions to TPAs to reduce fixed operational costs and improve scalability. Administrative activities such as policy issuance, billing, enrollment, customer communication, and compliance management require specialized expertise and advanced systems.

By outsourcing these functions, insurers gain access to experienced professionals, advanced analytics, and automation technologies without heavy capital investment. This trend is especially strong among mid-sized and rapidly expanding insurers seeking operational agility and cost efficiency.

Technological Advancements and Digital Transformation

Technology is transforming the TPA landscape. The adoption of artificial intelligence, cloud computing, automation, and data analytics has significantly enhanced the efficiency and accuracy of insurance administration. Digital platforms enable real-time data exchange, automated claims processing, predictive fraud detection, and improved reporting capabilities.

Cloud-based systems also allow TPAs to scale operations quickly, improve disaster recovery, and ensure data accessibility across geographies. Insurers increasingly favor TPAs with strong digital infrastructure, driving market growth in both developed and emerging economies.

Challenges in the Insurance Third Party Administrators Market

Regulatory Compliance and Data Privacy Risks

TPAs operate in a highly regulated environment and handle sensitive personal, medical, and financial data. Compliance with data protection laws and insurance regulations requires continuous investment in cybersecurity, compliance monitoring, and staff training.

Any lapse in compliance can result in legal penalties, reputational damage, and loss of client trust. The evolving nature of regulations across different regions adds complexity, particularly for TPAs operating internationally.

Intense Market Competition and Pricing Pressure

The global TPA market is highly competitive, with numerous regional and international service providers. This competition places downward pressure on pricing and profit margins. Smaller TPAs often struggle to compete with larger firms offering end-to-end digital solutions and global delivery capabilities.

To remain competitive, TPAs must continuously invest in innovation, service quality, and technology, which can strain financial resources and operational budgets.

Segment Analysis

Health Insurance Third Party Administrators Market

The health insurance segment dominates the TPA market due to rising healthcare costs, increasing insurance coverage, and complex medical claim processes. Health TPAs manage hospital networks, cashless treatments, claims adjudication, and fraud detection.

Growing hospitalization rates and expanding private and public health insurance programs continue to drive demand for specialized health insurance TPAs, particularly in countries with large populations and complex healthcare systems.

Motor Insurance Third Party Administrators Market

Motor insurance TPAs focus on accident claims processing, vehicle inspection coordination, repair network management, and settlement facilitation. They play a crucial role in reducing claim turnaround time and improving customer experience.

The increase in vehicle ownership, road accidents, and mandatory motor insurance regulations is fueling demand for motor insurance TPAs across both developed and emerging markets.

Claims Management Services Market

Claims management remains the core service offering within the TPA market. TPAs handle end-to-end claim workflows, from initial notification to final settlement. Efficient claims management reduces errors, ensures regulatory compliance, and improves insurer profitability.

As claims become more complex and data-intensive, insurers increasingly rely on TPAs for specialized claims expertise and technology-driven solutions.

End-User Analysis

Insurance Companies

Insurance companies represent the largest end-user segment. TPAs support insurers by managing policy administration, claims, customer service, fraud investigation, and data analytics. The rising number of insurers globally and the need for operational optimization continue to drive demand from this segment.

Large Enterprises and Self-Insured Employers

Large enterprises increasingly partner with TPAs to manage employee benefits, health plans, and workers’ compensation programs. TPAs offer scalable solutions, enterprise system integration, and advanced analytics that enable large organizations to control costs and improve service delivery.

Technology Analysis

Cloud-Based Platforms

Cloud-based TPAs are gaining rapid adoption due to their flexibility, scalability, and cost efficiency. Cloud platforms support real-time processing, automation, and remote accessibility while reducing infrastructure costs.

As insurers prioritize digital transformation and cybersecurity, cloud-enabled TPAs are becoming a preferred choice in the global market.

Regional Analysis

United States

The United States remains the largest market for insurance TPAs, supported by a highly developed insurance ecosystem, high healthcare expenditure, and strong regulatory oversight. TPAs play a critical role in managing health and motor insurance claims, fraud detection, and compliance reporting.

The trend toward outsourcing administrative services and adopting AI-driven platforms continues to fuel market growth in the country.

Germany

Germany’s TPA market benefits from a strong health and motor insurance framework and strict regulatory standards. TPAs support insurers by ensuring compliance, efficient claims handling, and secure data management.

Rising healthcare costs and increasing policy complexity are driving insurers to rely more heavily on professional administrators.

China

China represents one of the fastest-growing TPA markets due to expanding insurance coverage, government support for insurance adoption, and rapid digitalization. TPAs play a key role in claims management, fraud prevention, and coordination with hospitals and service providers.

The integration of digital health platforms and insurance technology is further accelerating market growth.

Saudi Arabia

Saudi Arabia’s TPA market is driven by mandatory health insurance regulations, growing motor insurance demand, and national digital transformation initiatives. TPAs help insurers comply with regulatory requirements while improving claims efficiency and service transparency.

Investments in healthcare infrastructure and digital platforms continue to create opportunities for advanced TPA solutions in the region.

Market Segmentation Overview

By Insurance Type

· Health Insurance

· Retirement and Pension

· Commercial General Liability

· Motor Insurance

· Workers’ Compensation

· Travel Insurance

By Service Type

· Claims Management

· Policy Administration

· Billing and Enrollment

· Provider Network Management

· Risk and Compliance Services

By End User

· Insurance Companies

· Self-Insured Employers

· Government Health Schemes

· Brokers and Reinsurers

By Enterprise Size

· Large Enterprises

· Small and Medium Enterprises

By Technology

· Cloud-Based Platforms

· On-Premise Solutions

· AI-Enabled TPAs

· Blockchain-Enabled TPAs

By Region

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East and Africa

Competitive Landscape and Key Players

The global Insurance Third Party Administrators market is moderately fragmented, with established multinational firms and regional players competing on service quality, technology adoption, and geographic reach. Key players focus on expanding digital capabilities, enhancing analytics, and strengthening regulatory compliance frameworks.

Companies are evaluated across multiple dimensions, including market overview, leadership strength, recent developments, SWOT analysis, and revenue performance. Continuous innovation, strategic partnerships, and technology investment remain critical to sustaining competitive advantage in this evolving market.

Conclusion

The Insurance Third Party Administrators market is positioned for steady long-term growth as insurers increasingly seek efficiency, scalability, and digital excellence. Rising claim volumes, healthcare costs, and regulatory complexity make TPAs indispensable partners in the modern insurance ecosystem.

With advancements in cloud computing, artificial intelligence, and automation, TPAs are evolving from back-office administrators to strategic enablers of insurer performance. As global insurance markets expand and customer expectations rise, the role of Third Party Administrators will continue to grow in importance through 2033 and beyond.

Comments

You must be logged in to comment.

Latest Articals

-

Faith, Healing, and Inner Change Through Inspirational Stories on Spiritual Growth

Spiritual growth rarely happens in comfort. It is often born in silence, struggle, guilt, doubt, and longing. In An Inward Journey, Peter Knoester walks through those very spaces. His reflections are not polished sermons or theological lectures. They are honest confessions, inner debates, prayers whispered in weakness, and meditations on eternity. Through his writing, readers encounter something deeply human: a soul wrestling with God, sin, redemption, and the mystery of existence.At its heart, this book offers inspirational stories on spiritual growth that unfold not through dramatic miracles, but through inward transformation. The author does not present himself as spiritually superior. Instead, he writes as someone aware of his flaws, haunted by his failures, and yet unwilling to stop seeking divine mercy. That honesty makes his reflections powerful and relatable.The Universal Longing for MeaningFrom the opening chapters, Knoester explores the shared human desire to connect with something beyond the material world. He...

-

99 Exchange Website | Smooth Access & Trusted Service at 99excha

IntroductionIn the fast pace of today’s digital world, users demand fast, secure and easy to use platforms. The 99 Exchange site shines through as a dependable place to get the best, whether you want to make sure you have the best experience or just want to pass through. Run by 99excha, this platform offers you performance, accessibility, and user trust — all in a single place. A Modern Platform Built for ConvenienceThe success of any online exchange platform depends on how easily users can access and interact with it. 99excha has developed the 99 Exchange website with a clean interface, fast-loading pages, and simple navigation tools. Whether you are a new visitor or a regular member, the layout ensures you can quickly find what you need without confusion.From streamlined menus to optimized mobile compatibility, every feature is built to support seamless browsing. The goal of 99excha is simple — provide smooth...

-

.jpg)

Birla Evara Sarjapur: Contemporary Skyline Living with Expansive Green Comfort

A modern home should offer more than just luxury—it should provide peace, connectivity, and thoughtfully designed spaces that enhance everyday life. Nestled in one of Bangalore’s most rapidly growing corridors, Birla Evara Sarjapur stands as a landmark residential township that perfectly blends urban sophistication with natural serenity. Spread across 25.71 acres, this premium development dedicates over 75% of its land to open spaces, creating a refreshing environment for residents.Designed under the LifeDesigned® philosophy, the township focuses on intelligent architecture, sustainable planning, and community-centric living. With high-rise towers, dual clubhouses, landscaped courtyards, and more than 25 lifestyle amenities, it sets a new benchmark for residential excellence on Sarjapur Road.A Prime Address in Bangalore’s Growth CorridorSarjapur Road has evolved into one of the city’s most sought-after residential zones. Its excellent connectivity to major IT parks and commercial hubs makes it ideal for professionals and families alike.Residents benefit from proximity to:Major IT corridorsOuter...

-

The Best Books on Leadership: Your Complete Guide to Building Trust, Strategy, and Integrity in Your Leadership Journey

Leadership is not defined by authority alone. It is revealed through decisions made under pressure, the ability to balance power with responsibility, and the courage to grow when control no longer works. Many leaders turn to the best books on leadership not to find shortcuts, but to understand how trust, strategy, and integrity can coexist. At the center of this conversation stands Machiavelli Mouse: A Search for Hybrid Wisdom by Phillip J. Velasquez—a leadership fable that reframes power as something to be carried wisely, not wielded blindly.This blog is written through the lens of Machiavelli Mouse, using its lessons as the foundation. Together, these lessons reflect why these types of books focus not on domination but on development.Why Machiavelli Mouse Belongs Among the Best Books on LeadershipMachiavelli Mouse earns its place among the best books because it addresses a problem many leaders face but rarely name: effectiveness without integrity eventually collapses. The story follows a...

-

A Guide to Fix QuickBooks Stuck on Installing ABS PDF Driver

If you are experiencing QBDT installation issues related to QuickBooks stuck on installing ABS PDF Driver, a missing or damaged driver most likely causes the issue. To resolve this, download and install the QuickBooks Tool Hub, then use it to run the QuickBooks Install Diagnostic Tool. In this blog, we will take a closer look at the potential causes of this error and walk you through detailed resolutions to resolve it. Understanding the Root Cause for Issues with ABS PDF Driver When Installing QBFirst, we need to explore and understand the reasons behind the ABS PDF driver when installing the application:If the QBW32.exe process is active while installing the drivers, it can interfere with and prevent successful installation Saving a file with the wrong extension or working on a file that is damaged or affected If the file does not have the required permissions or access to the specified location Security threats or issues...

-

Krishna Painting Trends: Radha Krishna Canvas Painting & Wall Painting Design by WallMantra

Spiritual art has always held a special place in Indian homes, and among all divine themes, Krishna painting continues to be the most cherished. Symbolizing love, harmony, and positivity, Radha Krishna artwork beautifully blends devotion with artistic elegance. From contemporary Radha Krishna Canvas Painting styles to thoughtfully crafted Radha Krishna Wall Painting Design trends, this form of art is evolving to match modern interiors.At WallMantra, we bring together tradition and design to create wall art that uplifts both your space and your spirit. Krishna Painting: Timeless Beauty with Spiritual MeaningA krishna painting is more than décor—it’s a symbol of divine love, compassion, and joy. Whether Krishna is depicted playing the flute, standing serenely by Radha, or surrounded by nature, each artwork creates a calming and positive ambiance.Why Krishna Paintings Are Always in Trend:They bring peace and spiritual energy into the homeThey suit both traditional and modern interiorsThey create an emotional...