Debt Collection Software Streamlining Financial Recovery and Complianc

"Global Executive Summary Debt Collection Software Market: Size, Share, and Forecast

The global debt collection software market Size was valued at USD 3.90 Billion in 2024 and is expected to reach USD 8.83 Billion by 2032, at a CAGR of 12.4 % during the forecast period

This Debt Collection Software Market research report contains specific segments by type and by application. Each type provides information about the production during the forecast period. The application segment also provides consumption during that forecast period. Comprehension of these segments helps in identifying the importance of different factors that aid the market growth. Development policies and plans are discussed well in the document. Also, manufacturing processes and cost structures are analyzed. This large scale Debt Collection Software business report also states import/export consumption, supply and demand figures, cost, price, revenue, and gross margins.

The Debt Collection Software Market report focuses on global major leading market players providing information such as company profiles, product picture and specifications, capacity, production, price, cost, revenue, and contact information. Analysis of upstream raw materials, equipment and downstream demand is also carried out. The feasibility of new investment projects is assessed and overall research conclusions are offered. Development trends and marketing channels of Debt Collection Software Market industry are analyzed as well in the report. With the list of tables and figures, the Debt Collection Software business report provides key statistics on the state of the industry and is an important source of guidance and direction for companies and individuals interested in the market.

Stay ahead with crucial trends and expert analysis in the latest Debt Collection Software Market report. Download now:

https://www.databridgemarketresearch.com/reports/global-debt-collection-software-market

Debt Collection Software Industry Overview

Segments

- Based on deployment mode, the global debt collection software market can be segmented into cloud-based and on-premises. The cloud-based segment is expected to witness significant growth due to its flexibility, scalability, and cost-effectiveness. Organizations are increasingly adopting cloud-based solutions to streamline their debt collection processes and improve overall efficiency. On the other hand, the on-premises segment is preferred by some enterprises that require complete control over their data and security.

- By organization size, the market can be categorized into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly recognizing the importance of efficient debt collection solutions to manage their cash flow and reduce bad debts. Large enterprises, on the other hand, are investing in advanced debt collection software to handle a higher volume of debtors and complex collection processes.

- On the basis of end-user industry, the market can be divided into banking, financial services, and insurance (BFSI), healthcare, retail, telecom, and others. The BFSI sector is expected to dominate the market share due to the increasing need for effective debt recovery solutions in the banking and financial services industry. The healthcare sector is also emerging as a key end-user segment, driven by the growing number of unpaid medical bills and the need to improve revenue cycle management.

Market Players

- Experian Information Solutions, Inc.

- Fair Isaac Corporation (FICO)

- CGI Inc.

- Pegasystems Inc.

- Temenos Headquarters SA

- Software Exports Ltd.

- Simplicity Collection Software

- Quantrax Corporation

- Lariat Software Inc.

- Katabat

- Chetu Inc.

The global debt collection software market is highly competitive, with a significant number of players offering a wide range of solutions to cater to the diverse needs of organizations. These market players are focusing on strategic partnerships, product innovations, and geographical expansions to strengthen their market position and gain a competitive edge.

The global debt collection software market is witnessing a paradigm shift driven by rapid digitization, changing consumer behavior, and the increasing need for efficient debt recovery solutions across various industries. An emerging trend in the market is the integration of advanced technologies such as artificial intelligence (AI), machine learning, and automation to optimize debt collection processes and enhance collection rates. Market players are increasingly focusing on developing intelligent software solutions that can analyze debtor behavior, predict payment patterns, and personalize communication strategies to improve debt recovery outcomes.

Moreover, the rising adoption of cloud-based debt collection software is revolutionizing the way organizations manage their debt collection operations. Cloud-based solutions offer enhanced flexibility, scalability, and cost-effectiveness compared to traditional on-premises software. They also enable real-time access to critical data, seamless integration with existing systems, and improved collaboration among teams, leading to faster and more effective debt recovery processes.

In terms of end-user industries, the banking, financial services, and insurance (BFSI) sector continue to drive significant demand for debt collection software due to the complex nature of debt recovery in financial institutions. With increasing regulatory requirements and rising levels of non-performing assets, banks and financial organizations are looking for advanced software solutions to streamline their collection operations and minimize credit risk. Additionally, the healthcare industry is emerging as a key market segment for debt collection software, driven by the need to manage outstanding medical bills, improve revenue cycle management, and enhance patient payment experiences.

Market players in the debt collection software sector are actively engaged in strategic initiatives to enhance their market presence and stay ahead of the competition. Partnerships and collaborations with technology providers, debt collection agencies, and financial institutions are being leveraged to expand product offerings and reach new customer segments. Furthermore, continuous investments in research and development are enabling companies to introduce innovative features such as predictive analytics, self-service portals, and compliance management tools to address the evolving needs of organizations in debt collection.

Overall, the global debt collection software market is poised for significant growth in the coming years as organizations across diverse industries prioritize efficient debt recovery processes, regulatory compliance, and customer experience optimization. With technological advancements and market dynamics driving the evolution of debt collection solutions, market players need to adapt quickly, innovate continuously, and forge strategic partnerships to capitalize on the immense opportunities offered by this dynamic market landscape.The global debt collection software market is experiencing a transformation driven by several key factors. One of the primary drivers of this market evolution is the increasing digitization across industries. As more organizations move towards digital processes, there is a growing need for efficient debt recovery solutions that can integrate seamlessly with existing systems and workflows. This shift towards digitalization is propelling the adoption of cloud-based debt collection software, offering enhanced flexibility, scalability, and cost-effectiveness compared to traditional on-premises solutions. Furthermore, the integration of advanced technologies like artificial intelligence, machine learning, and automation is revolutionizing debt collection processes by enabling predictive analytics, personalized communication strategies, and improved debtor behavior analysis.

Another significant trend shaping the debt collection software market is the changing consumer behavior, which is leading to a higher volume of unpaid debts across various sectors. This trend is particularly evident in industries such as retail, healthcare, and telecom, where organizations are facing challenges in recovering outstanding payments from customers. As a result, there is a growing demand for sophisticated debt collection solutions that can enhance collection rates, optimize recovery processes, and improve overall revenue cycle management. Market players are responding to this demand by developing intelligent software solutions that can address the specific needs of different end-user industries, offering tailored features and functionalities to streamline debt collection operations.

In terms of market competition, the global debt collection software market is highly competitive, with a diverse range of players vying for market share. To stay ahead in this competitive landscape, market players are focusing on strategic partnerships, product innovations, and geographical expansions to strengthen their market position and differentiate their offerings. Additionally, collaborations with technology providers, debt collection agencies, and financial institutions are enabling market players to expand their reach and cater to a broader customer base. Continuous investments in research and development are also driving innovation in the sector, with companies introducing new features and tools to meet the evolving needs of organizations in debt collection.

Overall, the global debt collection software market presents significant growth opportunities for market players as organizations across industries prioritize efficient debt recovery processes, regulatory compliance, and customer experience optimization. With technological advancements and changing market dynamics shaping the evolution of debt collection solutions, market players must continue to adapt, innovate, and forge strategic partnerships to capitalize on the immense potential of this dynamic market landscape.

Access detailed insights into the company’s market position

https://www.databridgemarketresearch.com/reports/global-debt-collection-software-market/companies

Alternative Research Questions for Global Debt Collection Software Market Analysis

- What is the current valuation of the global Debt Collection Software Market?

- What CAGR is projected for the Debt Collection Software Market over the forecast period?

- What are the key segments analyzed in the Debt Collection Software Market report?

- Which companies dominate the Debt Collection Software Market landscape?

- What geographic data is covered in the Debt Collection Software Market analysis?

- Who are the leading firms operating in the Debt Collection Software Market?

Browse More Reports:

North America Women Nutrition Market

Middle East and Africa Hernia Repair Devices (Permanent and Absorbable Hernia Fixation) Market

Europe Pre-shipment Inspection Market

Global Anti-cathepsin B Market

Global Mental Health Care Software and Services Market

Asia-Pacific Outdoor Cushions Market

Global Genomic Medicine Market

Middle East and Africa Marine Collagen Market

Global Polymer Nanomembrane Market

Global Angiography Equipment Market

Germany At-Home Testing Kits Market

Global Lead Poisoning Treatment Market

Europe Dermatology Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

Comments

You must be logged in to comment.

Latest Articals

-

Prioritise Spreader Beam for Safe Lifting Operations

When I first worked on lifting projects in fabrication yards and construction sites, I learned quickly that not all lifting gear behaves the same under load. A Priotise Spreader Beam is one of those tools that looks simple but controls forces in a way that prevents damage and accidents.I’ve seen steel frames twist, pipes bend, and loads slip just because the wrong beam was used. The right beam changes everything.What a Priotise Spreader Beam Actually DoesA Priotise Spreader Beam spreads the load between two or more lifting points so weight is shared evenly.Cause: uneven lifting force Effect: bent loads or broken slingsUsing a beam corrects this by keeping slings vertical and tension balanced.Why Load Distribution MattersWhen slings pull inward:Corners bendWelds crackCenter of gravity shiftsWith a beam:Load stays levelStress points reduceControl improvesExpert observation: Most load failures happen at connection points, not in the middle.Where Priotise Spreader Beam Is Commonly UsedFrom what...

-

Top 10 Courses for Web Development in 2026

If you’re sitting in your college canteen scrolling endlessly and suddenly wondering, “What am I actually doing with my career?” — welcome to the club. Almost every development student reaches this point. Web development often becomes the answer because it’s practical, creative, and let’s be honest, it pays well too.That’s why students constantly search for the top 10 courses for web development , top 10 institutes for web development. But choosing randomly can waste months. The right course, on the other hand, can completely change your direction.Let’s break it down in simple points, with examples so you actually understand what you’ll learn.Which Web Development Course Should You Choose in 2026?Before choosing from the top 10 courses for web development , top 10 institutes for web development, ask yourself these 3 questions:1. Do you want to become Frontend Developer? You’ll focus on what users see.Example:<h1>Hello Students</h1><button>Click Me</button>This creates text and a...

-

UAE E-Invoicing & Corporate Tax Services: Trusted Support for Compliance and Growth

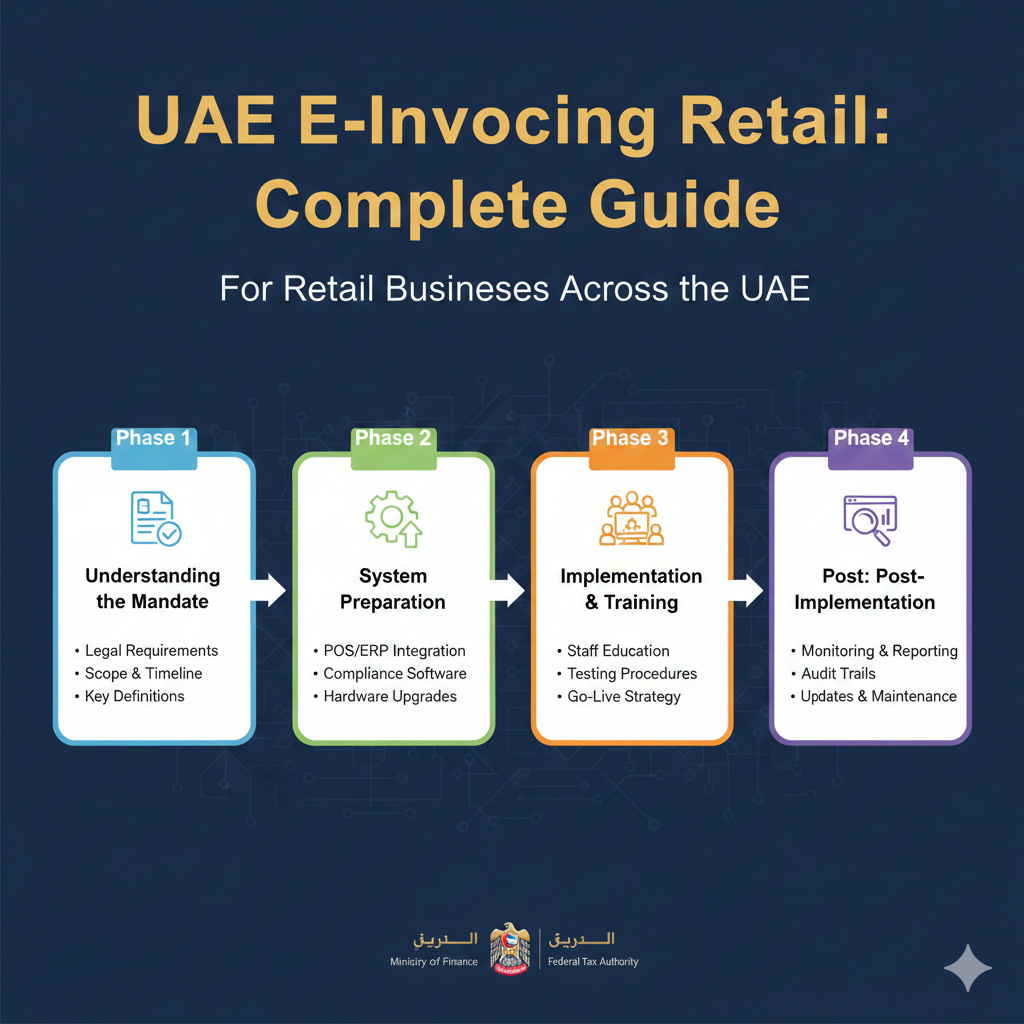

Businesses navigating digital taxation reforms often rely on a dubai e-invoicing consultant to ensure accurate reporting, seamless compliance, and efficient financial workflows. As regulatory expectations grow across the Dubai and the wider United Arab Emirates, companies must align invoicing, tax documentation, and reporting standards with government mandates. Partnering with experienced advisors helps organizations integrate einvoice systems, manage corporate tax obligations, and adapt to evolving frameworks.Understanding UAE E-Invoicing and Regulatory LandscapeE invoicing is becoming central to financial transparency and tax reporting. With increasing focus from the Federal Tax Authority, businesses are preparing for structured digital invoicing aligned with compliance standards. Organizations exploring how to prepare for uae e-invoicing are adopting secure platforms, validating invoice formats, and ensuring compatibility with reporting systems.The shift toward uae e-invoicing for b2b transactions is expected to streamline reporting, reduce fraud, and simplify audits. Companies must understand the e-invoicing implementation timeline uae and adopt compliant processes early...

-

How to Evaluate Customer Base

Understanding your customer base is one of the most important steps in growing your business. Whether you are planning to expand, launch a new product, or even sell a small business, knowing who your customers are and what they value can make a big difference. Let’s break down the process in simple, actionable steps.Why Evaluating Your Customer Base MattersEvaluating your customer base gives you insights into buying patterns, loyalty, and potential growth opportunities. If you plan to sell a small business, buyers will often look closely at your customer base to assess the value of your company. A strong, loyal, and diverse customer base can significantly increase your business’s attractiveness to potential buyers.Step 1: Segment Your CustomersStart by categorizing your customers into groups based on key characteristics such as demographics bizop , purchase behavior, and spending habits. This segmentation helps you understand which customer groups are most profitable and which...

-

Best Indian Restaurant in Eindhoven: Authentic Tastes and Fresh Dishes

Eindhoven finally has an Indian restaurant that refuses to compromise. Dhol and Soul isn't known for the same ten dishes available everywhere else. This is a restaurant that takes Indian cooking seriously. The kitchen celebrates regional diversity. They serve recipes passed through generations. They go beyond butter chicken and offer you real Indian flavors. This isn't fusion cuisine. This is India served loud and proud. The restaurant ranks number 1 on TripAdvisor among 528 indian restaurants in Eindhoven. That ranking reflects more than just good food. It reflects a team that actually understands what authenticity in Indian culinary traditions means. Dhol and Soul comes from the same makers as Rasoi Amsterdam, which means the expertise and commitment to quality are present here too.Eindhoven residents have been searching for genuinely good Indian food for a long time. Dhol and Soul gives them exactly that without cutting corners. The flavors are bold. The...

-

Man and Van Service in Dagenham That Makes Moving Easy and Reliable

FAQ 1: How can Decent Removal help me with my move in Dagenham? Decent Removal provides a complete man and van service in Dagenham to make your move smooth and stress free Their team helps with lifting packing and transporting your items safely Whether you have small boxes or large furniture Decent Removal ensures everything reaches your new home securely and on timeFAQ 2: Is Decent Removal reliable for moving fragile or heavy items? Yes Decent Removal takes extra care with fragile and heavy items Their team uses protective materials and proper handling techniques to make sure furniture electronics and delicate belongings arrive safely They focus on giving you peace of mind during every step of your moveFAQ 3: How do I book a man and van service with Decent Removal? Booking with Decent Removal is simple You can contact their team online or by phone Describe your moving needs...