Master Out-of-Court Debt Collection: Essential Tips for Installment Pl

In the complex landscape of financial recovery, Inkasso processes stand as a cornerstone for efficient debt resolution without the burdens of litigation. Out-of-court debt collection offers businesses and creditors a streamlined pathway to reclaim owed amounts while preserving valuable relationships with debtors. This approach emphasizes negotiation, empathy, and strategic planning, allowing for resolutions that are both swift and cost-effective. By mastering these techniques, organizations can minimize losses, enhance cash flow, and avoid the protracted timelines associated with judicial interventions. As global economies fluctuate, the demand for adept out-of-court debt collection strategies has surged, particularly in sectors like retail, finance, and services where installment-based transactions are commonplace. This comprehensive guide delves into the intricacies of implementing installment plans and seamlessly transitioning to legal enforcement when necessary, equipping you with actionable insights to optimize your recovery efforts.

The Foundations of Out-of-Court Debt Collection

Out-of-court debt collection begins with a thorough assessment of the debtor's situation, ensuring that every step aligns with ethical and regulatory standards. Unlike aggressive tactics that alienate parties, this method prioritizes dialogue and mutual understanding. Creditors must first verify the debt's validity, gathering documentation such as invoices, contracts, and communication records to substantiate claims. This preparation not only bolsters credibility but also sets the tone for productive negotiations.

A key element in this phase is establishing clear communication channels. Initial contact should be professional, outlining the outstanding amount, due dates, and potential consequences of non-payment without resorting to threats. For instance, sending a formal demand letter via certified mail provides a paper trail while giving the debtor a reasonable window—typically 14 to 30 days—to respond. During this period, empathy plays a pivotal role; understanding the debtor's financial constraints, such as unexpected medical expenses or job loss, can open doors to collaborative solutions.

Moreover, compliance with laws like the Fair Debt Collection Practices Act (FDCPA) in the U.S. or equivalent regulations in the EU is non-negotiable. Violations can lead to penalties, undermining the entire process. By focusing on transparency and respect, out-of-court efforts often yield higher recovery rates—up to 70% in some studies—compared to court proceedings, which hover around 40%.

Key Benefits of Amicable Debt Resolution

The advantages of resolving debts outside the courtroom extend far beyond immediate financial gains. Primarily, it reduces operational costs; legal fees, court filings, and expert witnesses can escalate expenses by thousands per case, whereas negotiation requires minimal resources. Time efficiency is another boon—resolutions can conclude in weeks rather than months or years, freeing up internal teams to focus on core business activities.

From a relational standpoint, maintaining positive ties with debtors preserves future opportunities. A satisfied client who settles through installment plans might return as a repeat customer, bolstering long-term revenue streams. Additionally, this approach enhances a company's reputation in the industry, positioning it as a fair and flexible partner rather than an adversarial force.

Crafting Effective Installment Plans for Debt Recovery

Installment plans represent a flexible lifeline in out-of-court debt collection, transforming overwhelming lump-sum demands into manageable payments. Designing these plans requires a balance between the creditor's need for prompt recovery and the debtor's capacity to pay, ensuring sustainability to prevent defaults.

Begin by conducting a detailed financial analysis of the debtor. Request bank statements, income verification, and expense breakdowns to gauge affordability. Tools like debt-to-income ratio calculations—where payments should not exceed 20-30% of monthly income—provide a data-driven foundation. For example, if a debtor owes $10,000, propose dividing it into 12 monthly installments of $833, adjusted based on their cash flow projections.

Customization is crucial; rigid templates fail where tailored solutions succeed. Incorporate grace periods for the first payment, interest waivers for early settlements, or escalators for extended terms. Document everything in a written agreement, specifying amounts, due dates, late fees (capped at reasonable rates), and default triggers. Digital platforms for automated reminders and payments streamline enforcement, reducing administrative overhead.

Negotiating Flexible Payment Schedules

Negotiation tactics elevate installment plans from mere stopgaps to robust recovery mechanisms. Start with an opening offer that's slightly higher than your minimum acceptable terms, creating room for concessions. Active listening—acknowledging the debtor's hardships—builds trust; phrases like "We understand this has been challenging; let's find a way forward together" disarm defensiveness.

Incorporate incentives to encourage compliance, such as discounts for on-time payments or priority support for future dealings. For seasonal businesses, align schedules with peak earning periods, like quarterly payments post-holiday sales. Monitor progress quarterly, adjusting as needed for life events like promotions or relocations. Success stories abound: a mid-sized retailer recovered 85% of delinquent accounts by offering interest-free installments tied to sales milestones, far outpacing traditional demands.

Legal safeguards within these plans are essential. Include clauses for acceleration—where missed payments trigger the full balance due—and rights to reclaim collateral if applicable. Regular reviews ensure the plan remains viable, with escalation protocols clearly defined.

Transitioning to Legal Enforcement: Strategic Escalation

While out-of-court methods shine in efficiency, not all debts yield to negotiation. Recognizing impasse signs—such as ignored communications or partial payments without commitment—signals the need for legal enforcement. This shift demands meticulous preparation to maximize enforceability and minimize risks.

First, exhaust amicable avenues with a final notice, reiterating consequences and offering one last settlement opportunity. Document all prior interactions to demonstrate good-faith efforts, a prerequisite for court admissibility in many jurisdictions.

Preparing Robust Documentation for Court

Evidence is the bedrock of successful legal action in debt collection. Compile a comprehensive dossier: original contracts, payment histories, correspondence logs, and proof of delivery. Affidavits from witnesses or experts can corroborate claims, while forensic accounting reports dissect disputed amounts.

Engage specialized attorneys early; their expertise in local statutes—such as statutes of limitations varying from 3-10 years by debt type—prevents procedural missteps. Pre-litigation mediation, often court-mandated, serves as a final out-of-court bridge, resolving up to 60% of cases without trial.

Cost-benefit analysis guides decisions: pursue if the debt exceeds projected legal expenses by at least 50%. Alternative dispute resolution (ADR) mechanisms, like arbitration, offer faster, binding outcomes at lower costs.

Executing Enforcement Post-Judgment

Securing a judgment is merely the prelude; enforcement extracts value. Garnish wages up to 25% of disposable income under FDCPA guidelines, or levy bank accounts after exemptions for essentials. Liens on property encumber assets until satisfaction, while asset seizures target non-exempt holdings like vehicles.

International debts complicate matters, necessitating treaties like the Hague Convention for cross-border recognition. Technology aids here—AI-driven tracking tools monitor debtor assets in real-time, optimizing levy targets.

Post-enforcement, reporting to credit bureaus impacts scores for seven years, deterring future delinquencies. Yet, balance firmness with fairness; voluntary compliance post-judgment often follows empathetic follow-ups.

Advanced Strategies for Optimizing Debt Collection Outcomes

To elevate your out-of-court debt collection prowess, integrate technology and analytics. CRM systems with predictive modeling forecast default risks, enabling proactive installment offers. AI chatbots handle initial queries 24/7, escalating to humans for nuanced talks.

Training teams on psychological principles—reciprocity in concessions, scarcity in deadlines—boosts persuasion rates. Benchmark against industry standards: finance firms averaging 65% recovery via installments underscore the value of persistence.

Risk mitigation includes portfolio segmentation—prioritizing high-value debts for legal paths while nurturing low-value ones amicably. Annual audits refine processes, adapting to economic shifts like inflation eroding debt values.

Conclusion: Empowering Sustainable Financial Health

Mastering out-of-court debt collection through astute installment plans and judicious legal enforcement fortifies organizational resilience. By prioritizing dialogue, documentation, and adaptability, creditors not only recover funds but cultivate enduring partnerships. In an era of economic volatility, these strategies ensure liquidity without compromising integrity, positioning your business for sustained success. Implement these tips iteratively, measuring outcomes via key metrics like recovery ratios and resolution times, to refine your approach continually.

Comments

You must be logged in to comment.

Latest Articals

-

Premium Custom Liquid Soap Boxes by Bexo Packaging

Packaging plays a critical role in the success of any product. For personal care products like liquid soaps, the packaging is just as important as the product itself. Not only does it protect the contents, but it also serves as the first point of contact with customers. At Bexo Packaging, we understand the value of high-quality packaging that showcases your brand and ensures the safety of your product.Our Custom Liquid Soap Boxes are specifically designed to offer both durability and aesthetics, creating the perfect packaging for your liquid soap products. Whether you’re looking for eco-friendly options or premium finishes to align with your brand’s image, Bexo Packaging delivers tailored packaging solutions that stand out in the market and resonate with customers.The Importance of Custom Packaging for Liquid SoapWhen it comes to liquid soap, the packaging is critical not only for functionality but also for building brand identity. Custom Liquid Soap...

-

Premium Packaging Solutions by Bexo Packaging

In the world of gifting and stationery, presentation plays a powerful role in how a product is perceived. A beautifully designed card can lose its charm if it is not packaged properly, while the right box can instantly elevate its value. At Bexo Packaging, we understand that packaging is not just a protective layer—it is part of the emotional experience that gifting creates.Our custom packaging solutions are designed to protect delicate products while enhancing their visual appeal. Whether your brand focuses on luxury greeting cards, handmade stationery, or corporate gifting, our packaging helps create a memorable first impression that reflects quality and professionalism.Enhancing the Value of Greeting Cards Through Thoughtful PackagingGreeting cards often carry emotional meaning, making their presentation just as important as the message inside. When brands invest in premium packaging, they enhance the perceived value of their cards and create a more complete gifting experience. This is where...

-

Custom Waffle Cone Sleeves: Elevate Your Brand with Smart, Stylish Packaging

In today’s competitive food and dessert market, packaging is no longer just about protection—it is about presentation, branding, and customer experience. For ice cream shops, dessert cafés, food trucks, and premium confectionery brands, waffle cones are a signature product that deserves packaging just as memorable as the treat itself. At Bexo Packaging, we specialize in high-quality Custom Waffle Cone Sleeves designed to enhance your brand image while delivering practical benefits for everyday service.Waffle cone sleeves may seem like a small detail, but they play a powerful role in how customers perceive your product. From preventing mess to showcasing your logo, these sleeves are a smart investment for businesses that want to stand out, stay hygienic, and build long-term brand recognition.Why Custom Waffle Cone Sleeves Matter for Your BusinessWaffle cones are loved for their crunch, aroma, and visual appeal—but they can also be messy. Without proper sleeves, customers struggle with sticky...

-

Premium Custom Slider Child Resistant Boxes for Safe Packaging

In industries where product safety, compliance, and presentation matter the most, packaging must be thoughtfully designed. Modern businesses are no longer satisfied with basic boxes; they need packaging that ensures security, enhances brand value, and meets regulatory standards. At Bexo Packaging, we specialize in creating packaging solutions that combine durability, innovation, and premium aesthetics.Our custom packaging is designed to protect sensitive products while reinforcing trust with customers. From retail shelves to shipping environments, our solutions help brands deliver products confidently and professionally.Secure Packaging Designed for Safety and ComplianceWhen packaging involves sensitive or regulated products, safety becomes a top priority. Many industries require packaging that prevents unauthorized access while remaining convenient for adult users. This is where Custom Slider Child Resistant Boxes become an essential solution for modern brands.Designed with a sliding lock mechanism, these boxes reduce the risk of accidental access by children while maintaining ease of use for adults....

-

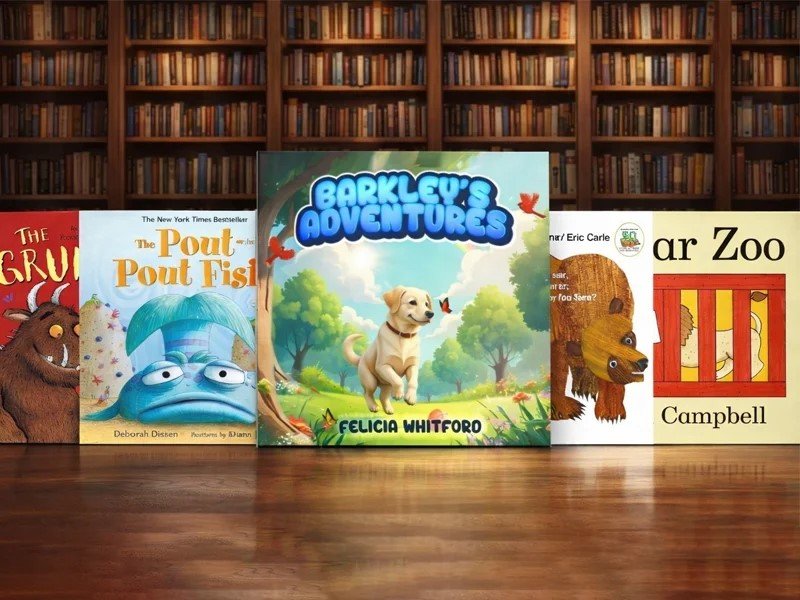

Picture Books About Animals for Kids: Engaging Stories of Curiosity and Companionship

Stories featuring animals have always held a special place in children’s literature. Through animal characters, young readers learn empathy, responsibility, curiosity, and the importance of relationships in ways that feel safe, playful, and emotionally accessible. Picture books about animals for kids are particularly effective because they combine visual storytelling with simple, meaningful narratives that support early literacy and emotional development.One book that reflects these values beautifully is Barkley’s Adventures by Felicia Whitford. Through Barkley, a lovable Labrador, and his human family, children are guided through everyday experiences and exciting outings that mirror real-life emotions—joy, uncertainty, curiosity, and connection. This blog examines how animal-led stories, such as Barkley’s Adventures, fit within the broader world of picture books and why they continue to resonate with young readers and their families.Why Animal Stories Matter in Early ChildhoodChildren naturally gravitate toward animals. They observe them, ask questions about them, and often form emotional bonds with...

-

Emerging Intelligent Methodologies for Identifying Premium Tile Roofing Solutions

The development of architecture for residential homes in 2026 has transformed the roof's role from being a basic layer of protection to a functional part of the home's structural and thermal ecosystem. Although sophisticated homeowners frequently seek out the best tile roofing experts within Dallas to preserve the historic and aesthetic quality of their homes the process of selecting a roofing contractor requires a thorough evaluation of technical expertise. Modern tile systems, whether made of high-density concrete or kiln-fired clay, they require a specialist understanding of the dynamics of load bearing and advanced underlayment techniques which go beyond the typical shingle installationsStructural Load Analysis and Reinforced Framing ProtocolsAdvanced Underlayment Systems and Moisture BarriersThermal Mass Regulation and Attic Climate ControlPrecision Mechanical Fastening and Wind-Lift MitigationDrone-Assisted Forensic Inspections and Digital ModelingSustainability Metrics and End-of-Life RecyclabilityThe technological superiority of the latest tile installation is usually determined by its capacity to utilize the thermal mass of a high...