UAE Corporate Tax Services for Businesses Navigating Compliance, Growt

The introduction of corporate tax in the UAE has reshaped how businesses approach compliance, reporting, and long-term financial planning. What was once a tax-free environment now requires structured processes, expert guidance, and proactive compliance strategies. This is where UAE corporate tax services play a crucial role in helping businesses adapt smoothly while maintaining operational efficiency.

From corporate tax registration and return filing to advisory support for VAT and e-invoicing in the retail sector, professional tax services are no longer optional—they are essential for sustainable growth in the UAE market.

Understanding the UAE Corporate Tax Landscape

The UAE corporate tax regime applies to most mainland and free zone entities that meet the taxable income threshold. Businesses must now ensure:

- Accurate corporate tax registration

- Proper classification of taxable and exempt income

- Timely return filing and documentation

- Alignment with Federal Tax Authority (FTA) regulations

Without expert assistance, even minor errors can result in penalties, delayed approvals, or compliance risks.

Professional UAE corporate tax services help businesses interpret regulations correctly and implement systems that align with local laws while supporting scalability.

Comprehensive UAE Corporate Tax Services for All Business Types

A structured tax approach goes beyond filing returns. End-to-end corporate tax solutions typically include:

Corporate Tax Registration and Assessment

Businesses must assess applicability, determine taxable income, and complete FTA registration accurately. This is especially important for SMEs and startups unfamiliar with tax compliance in the region.

Corporate Tax Return Filing

Preparing and filing corporate tax returns requires proper financial records, reconciliations, and disclosures. Expert review minimizes errors and ensures compliance with evolving tax guidelines.

Tax Planning and Advisory

Strategic planning helps businesses legally optimize tax exposure while staying compliant. This includes structuring operations, evaluating free zone benefits, and understanding cross-border implications.

Compliance Health Checks

Periodic tax audits and compliance reviews identify gaps before regulatory inspections occur, reducing risk and penalties.

The Growing Role of E-Invoicing in Retail Compliance

Alongside corporate tax, the UAE is steadily moving toward digital compliance systems, including e-invoicing—especially for retail businesses. Retailers must align invoicing practices with tax reporting to ensure transparency and accuracy.

Retail businesses operating across the UAE increasingly adopt UAE e-invoicing for retail to streamline billing, reporting, and audit readiness. Whether it’s retail e-invoicing UAE or integrating UAE e-invoice retail systems, digital invoicing supports seamless tax compliance.

In practice, retailers using UAE einvoicing retail solutions experience better data accuracy, faster reconciliations, and improved alignment with corporate tax filings.

Retail E-Invoicing Across UAE Locations

Retail operations vary by emirate, but compliance expectations remain consistent. Businesses are implementing retail e-invoicing for retail operations across multiple regions, including:

- Retail e-invoicing Abu Dhabi for large commercial hubs

- Retail e-invoicing Dubai supporting high-volume retail chains

- Retail e-invoicing Sharjah for SMEs and distributors

- Retail e-invoicing Ajman for growing local retailers

- Retail e-invoicing Fujairah for regional trade businesses

- Retail e-invoicing Umm Al Quwain for small retail entities

- Retail e-invoicing Ras Al Khaimah for manufacturing-linked retail

Integrating UAE e-invoice for retail systems with accounting and tax platforms ensures consistency across all emirates.

Why Businesses Choose Professional UAE Corporate Tax Services

Managing corporate tax internally can be time-consuming and risky, particularly when combined with VAT, e-invoicing, and financial reporting obligations. Professional service providers help businesses by:

- Reducing compliance risks

- Ensuring timely filings and documentation

- Supporting digital tax transformation

- Offering expert guidance tailored to industry needs

Retailers, in particular, benefit from aligning corporate tax strategies with retail einvoicing UAE requirements to maintain accurate financial records.

AIS Business Corp Pvt Ltd – Trusted Partner for UAE Corporate Tax Services

AIS Business Corp Pvt Ltd delivers comprehensive UAE corporate tax services designed to support businesses at every stage of compliance. With a strong understanding of UAE tax regulations and digital invoicing frameworks, AIS helps organizations stay compliant while focusing on growth.

From corporate tax registration and return filing to advisory services and retail e-invoicing integration, AIS Business Corp Pvt Ltd provides reliable, scalable solutions for mainland and free zone companies across the UAE.

Future-Ready Compliance for UAE Businesses

As the UAE continues to modernize its tax ecosystem, businesses must adopt proactive compliance strategies. Corporate tax, combined with digital initiatives like e-invoicing, signals a shift toward transparency and efficiency.

Partnering with experienced professionals ensures your business remains compliant today and prepared for future regulatory developments.

FAQs – UAE Corporate Tax Services

What are UAE corporate tax services?

UAE corporate tax services include registration, return filing, tax advisory, compliance reviews, and ongoing support to help businesses meet FTA regulations efficiently.

Who needs to register for corporate tax in the UAE?

Most mainland businesses and qualifying free zone entities meeting the taxable income threshold must register for UAE corporate tax.

How does corporate tax affect retail businesses?

Retail businesses must align corporate tax filings with accurate invoicing and financial records. Implementing UAE e-invoicing for retail helps ensure compliance and transparency.

Is e-invoicing mandatory for retail in the UAE?

While implementation is evolving, adopting UAE e-invoice retail systems prepares businesses for future mandates and simplifies tax reporting.

How can AIS Business Corp Pvt Ltd help with corporate tax compliance?

AIS Business Corp Pvt Ltd offers end-to-end corporate tax services, including registration, filing, advisory, and retail e-invoicing support across all UAE emirates.

Comments

You must be logged in to comment.

Latest Articals

-

Advanced Skin Rejuvenation at Richmond Clinic Brussels with Skinbooster Brussels & HIFU Brussels Treatments

Richmond Clinic Brussels is a leading destination for advanced non-surgical aesthetic treatments, offering medically guided solutions designed to enhance skin quality, firmness, and overall appearance. Among the most in-demand procedures at the clinic are Skinbooster Brussels and HIFU Brussels treatments, both recognized for delivering natural-looking rejuvenation with minimal downtime.Modern Skin Rejuvenation at Richmond Clinic BrusselsSkin aging is a natural process influenced by time, environmental exposure, stress, and lifestyle habits. As collagen and hyaluronic acid levels decrease, the skin gradually loses hydration, elasticity, and firmness. Richmond Clinic Brussels focuses on restoring skin health from within using scientifically proven methods such as Skinbooster Brussels and HIFU Brussels, which stimulate the body’s natural regenerative mechanisms rather than masking signs of aging.Skinbooster Brussels: Enhancing Skin Quality from WithinSkinbooster Brussels treatments are specifically designed to improve skin hydration, texture, and elasticity. Unlike traditional fillers that add volume, Skinbooster Brussels uses micro-injections of stabilized hyaluronic acid...

-

Why Are VPS Hosting Plans Best for Growth in 2026?

The online marketplace in 2026 is more competitive than ever. Businesses, bloggers, and e-commerce platforms are all striving to deliver faster, more secure, and more reliable digital experiences. Hosting plays a central role in this effort, and while shared hosting may be affordable, it often fails to meet the demands of growing websites. Dedicated servers, on the other hand, provide power but come with high costs. This is where VPS hosting steps in, offering the perfect balance of affordability, performance, and scalability.Virtual Private Server (VPS) hosting has become the go-to solution for businesses that want to expand without overspending. It provides dedicated resources, stronger security, and greater control compared to shared hosting, making it ideal for websites that handle customer data, online transactions, or dynamic content. Let’s explore why VPS hosting plans are the best choice for growth in 2026.ScalabilityOne of the most important advantages of VPS hosting is scalability....

-

RICS Level 3 Building Survey in Richmond – Is It Worth It?

If you’re buying an older or character property, you may be wondering:“Is a RICS Level 3 Building Survey worth it in Richmond?”For many buyers, the answer is yes, especially given the area’s housing stock.What Is a RICS Level 3 Building Survey?A RICS Level 3 Building Survey is the most comprehensive property inspection available. It provides:Detailed structural analysisIdentification of defects and causesRepair options and prioritiesLong-term maintenance adviceIt goes far beyond a surface-level check.When Is a Level 3 Survey Recommended in Richmond?A Level 3 survey is strongly recommended if:The property is Victorian or EdwardianThe building has been altered or extendedThere are visible defectsYou plan renovationsThe construction is non-standardMany Richmond properties fall into these categories.What Does a Level 3 Survey Reveal That Others Don’t?Unlike lighter surveys, a Level 3 survey explains:Why defects existHow serious they areWhat repairs may involveLikely future maintenance costsThis level of detail supports informed decision-making.Is It Worth the Extra Cost?While...

-

One AI Platform. Complete SEO Services. Real Ranking Growth.

SEO today isn’t about doing more—it’s about doing what works. Brands that dominate search results rely on data, competitive intelligence, and quality-first execution.Vefogix is an AI Powered Competitor Guest Post Checker & Guest Post Marketplace built to eliminate guesswork from SEO. It shows you exactly where your competitors are building backlinks, which sites are worth targeting, and how your links perform over time using the AI Backlink Monitor Tool.The result? Higher rankings, stronger authority, and real organic traffic.Let’s break down how Vefogix-powered services help you scale SEO efficiently.Press Release Distribution ServiceBrand announcements deserve more than a simple publish-and-forget approach.Our Press Release Distribution Service helps businesses share news across authoritative media outlets and industry-relevant platforms. Each distribution is designed to improve visibility, strengthen brand trust, and generate organic backlinks.With Vefogix-powered PR distribution, you benefit from:Exposure on high-authority publicationsIncreased brand credibility and mentionsSEO-friendly editorial backlinksAt Vefogix, you invest in trust; we build...

-

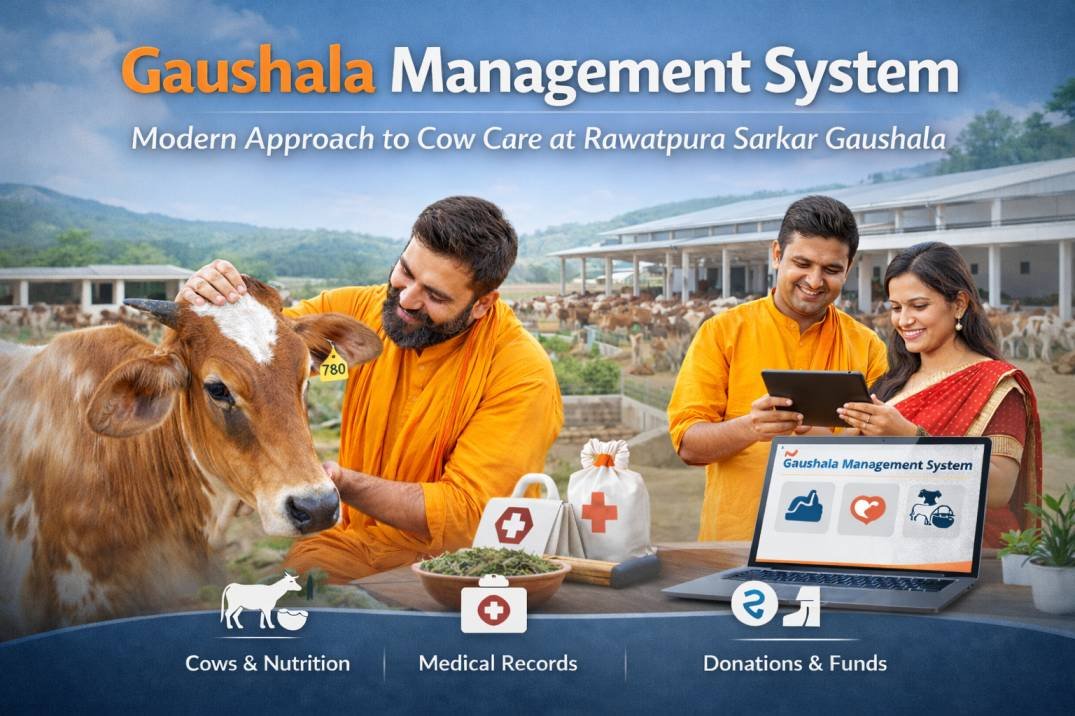

Gaushala Management System – A Modern Approach to Cow Care at Rawatpura Sarkar Gaushala

A gaushala management system plays a vital role in ensuring the proper care, safety, and well-being of cows while maintaining transparency and efficiency in daily operations. As cow shelters grow in size and responsibility, managing resources, health records, donations, and daily activities becomes increasingly complex. At Rawatpura Sarkar Gaushala, a structured and well-organised management system helps preserve traditional values while embracing modern practices for better Cow Care.Importance of a Gaushala Management SystemA gaushala is not just a shelter—it is a place of compassion, service, and responsibility. Without a proper gaushala management system, it becomes difficult to track cow health, feeding schedules, medical treatment, staff duties, and donor contributions. A well-planned system ensures that every cow receives timely care, nutritious food, and medical attention while maintaining accountability and sustainability.For a reputed institution like Rawatpura Sarkar Gaushala, an effective management system supports ethical Cow Care and long-term operational success.Enhancing Cow Care Through...

-

.png)

NRI Tax Advisory Services: Simplifying Global Tax Responsibilities

With the growing number of Indians living and working overseas, managing tax obligations in India has become a critical concern. Non-Resident Indians (NRIs) often have income sources in India such as rental income, capital gains, dividends, or business interests. Navigating Indian tax laws while staying compliant with international regulations can be overwhelming. This is why professional NRI tax advisory services have become essential for global Indians seeking accuracy, compliance, and tax efficiency.Understanding NRI Taxation in IndiaNRI taxation in India is governed by the Income Tax Act, 1961, and is primarily based on residential status. NRIs are taxed only on income earned or received in India, unlike resident Indians who are taxed on global income. Determining residential status correctly is crucial, as even a minor miscalculation can lead to incorrect tax filings and penalties. Expert NRI tax consultants ensure proper classification and guide clients through applicable tax rules.Key Income Sources Taxable...