How to Read Financial Statements Prepared Under U.S. GAAP

In the world of accounting and finance, U.S. GAAP — or Generally Accepted Accounting Principles — forms the foundation for how financial information is recorded, reported, and interpreted. Whether you’re a seasoned accountant, a business owner, or a startup founder, understanding the basics of U.S. GAAP is crucial to making informed financial decisions and staying compliant.

In this article, we’ll break down what U.S. GAAP Basics is, why it matters, and how it impacts the way businesses operate today.

What Is U.S. GAAP?

U.S. GAAP (Generally Accepted Accounting Principles) refers to a standardized set of accounting rules, conventions, and procedures that companies in the United States must follow when preparing financial statements.

These principles are designed to ensure consistency, transparency, and comparability in financial reporting, so investors, regulators, and stakeholders can accurately evaluate a company’s financial health.

U.S. GAAP is governed by the Financial Accounting Standards Board (FASB), which develops and updates accounting standards through an extensive due process that includes public input and expert analysis.

Why U.S. GAAP Matters

Without a consistent framework like GAAP, financial statements could vary widely in format and interpretation, making it nearly impossible to compare two companies accurately.

Here’s why U.S. GAAP is so important:

- Consistency: GAAP ensures that financial statements are prepared using the same methods, allowing for consistent comparisons across industries and time periods.

- Credibility: Investors, lenders, and regulators rely on GAAP-compliant reports to make decisions based on trustworthy data.

- Transparency: GAAP promotes full disclosure of financial information, reducing the risk of manipulation or misinterpretation.

- Legal Requirement: Publicly traded companies in the U.S. are required by the Securities and Exchange Commission (SEC) to prepare their financial statements in accordance with GAAP.

Even privately held businesses often follow GAAP voluntarily because it increases the reliability of their financial reporting and strengthens relationships with investors and banks.

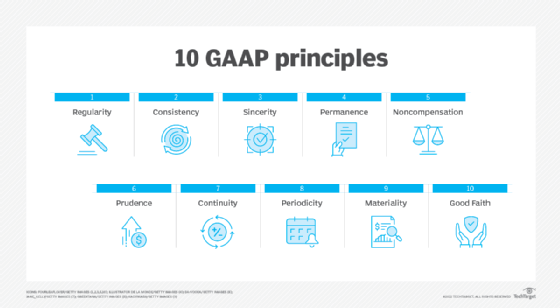

The Core Principles of U.S. GAAP

U.S. GAAP is built around a set of fundamental principles and concepts that guide accountants in preparing accurate financial statements.

Let’s look at the most important ones:

1. Principle of Regularity

Accountants must strictly adhere to established GAAP rules and standards, maintaining consistency and discipline in reporting.

2. Principle of Consistency

Once a company chooses an accounting method (e.g., inventory valuation or depreciation), it should use that same method year after year unless a justified change is disclosed.

3. Principle of Sincerity

Financial statements must reflect the company’s actual financial position without bias or manipulation.

4. Principle of Prudence (Conservatism)

Accountants should not overstate revenues or assets and should recognize expenses and liabilities as soon as they are probable.

5. Principle of Permanence of Methods

Using consistent procedures over time allows for meaningful comparisons across reporting periods.

6. Principle of Non-Compensation

All aspects of performance—profits, losses, assets, and liabilities—must be reported separately without offsetting one against another.

7. Principle of Full Disclosure

All relevant financial information that could influence decision-making must be disclosed in the financial statements or accompanying notes.

Key Components of Financial Statements Under U.S. GAAP

To comply with GAAP, companies typically prepare four core financial statements:

- Balance Sheet (Statement of Financial Position):

- Shows a company’s assets, liabilities, and equity at a specific point in time.

- Income Statement (Profit and Loss Statement):

- Summarizes revenues, expenses, and profits over a reporting period.

- Statement of Cash Flows:

- Tracks cash inflows and outflows from operations, investing, and financing activities.

- Statement of Changes in Equity:

- Details changes in owners’ equity, such as retained earnings or issued shares.

Together, these statements provide a comprehensive picture of a company’s financial performance and stability.

U.S. GAAP vs. IFRS: What’s the Difference?

While U.S. GAAP is used primarily in the United States, many other countries follow the International Financial Reporting Standards (IFRS).

Here are a few key differences between the two frameworks:

- Approach: GAAP is more rules-based, while IFRS is more principles-based, allowing for broader interpretation.

- Inventory Valuation: GAAP allows the LIFO (Last In, First Out) method; IFRS does not.

- Development Costs: Under IFRS, certain development costs can be capitalized, whereas GAAP typically requires them to be expensed immediately.

- Revaluation of Assets: IFRS allows periodic revaluation of fixed assets, but GAAP generally records them at historical cost.

For global companies operating in multiple jurisdictions, understanding these differences is essential to maintain compliance and consistency across reporting standards.

Recent Developments in U.S. GAAP (2025 Update)

U.S. GAAP continues to evolve as business models and financial environments change. Some of the most recent focus areas include:

- Revenue Recognition (ASC 606): Standardizing how and when revenue is recognized across industries.

- Leases (ASC 842): Requiring companies to recognize lease liabilities and right-of-use assets on the balance sheet.

- Credit Losses (CECL Model): Introducing a forward-looking approach to estimating credit losses for financial institutions.

- Disclosure Improvements: Enhancing the clarity and relevance of notes to financial statements.

Staying up to date with new FASB updates is essential for accountants and business owners to remain compliant and accurate in reporting.

Why Business Owners Should Understand U.S. GAAP

Even if you’re not an accountant, having a basic understanding of GAAP gives you a clearer view of your company’s financial performance.

It helps you:

- Interpret financial reports more accurately

- Communicate effectively with accountants and auditors

- Make informed strategic and investment decisions

- Present credible financial information to investors or lenders

In short, U.S. GAAP ensures that everyone — from executives to investors — speaks the same “financial language.”

Final Thoughts

Understanding U.S. GAAP basics isn’t just about following accounting rules — it’s about building a solid financial foundation for your business.

By adhering to GAAP standards, companies create transparent, reliable, and comparable financial statements that instill confidence among investors, regulators, and management.

As financial regulations continue to evolve, staying informed about GAAP principles and updates will help your business stay compliant, competitive, and financially sound in 2025 and beyond.

Whether you’re managing a small business or running a public company, one thing is certain: U.S. GAAP remains the gold standard for trustworthy financial reporting.

Comments

You must be logged in to comment.

Latest Articals

-

.jpeg)

Adult Orthodontic Options for Healthier, Aligned Smiles in Sea Girt, NJ

Adult orthodontic treatment has become an increasingly popular choice for improving both dental health and appearance. At Your Dentalist in Sea Girt, NJ, adults have access to modern orthodontic options designed for comfort, discretion, and efficiency. Straighter teeth are not only about aesthetics but also about maintaining long-term oral health.Many adults seek orthodontic care to correct shifting teeth, bite problems, or alignment concerns that were never treated earlier. With today’s advanced solutions, achieving a healthy, aligned smile is more accessible than ever. Why Adults Choose Orthodontic TreatmentAdult orthodontic care addresses issues that can affect daily comfort and dental health. Misaligned teeth may contribute to uneven wear, jaw discomfort, and difficulty cleaning certain areas. Orthodontic treatment helps correct these problems and supports overall oral function.Beyond health benefits, orthodontic care enhances confidence. A well-aligned smile often improves personal and professional interactions. Common Orthodontic Concerns in AdultsAdult patients often experience dental changes over...

-

How AI-Powered Link Building Is Replacing Traditional SEO Outreach

For years, link building meant endless emails, uncertain replies, and backlinks that didn’t always improve rankings. In 2026, that model is breaking fast. Businesses now want clarity, control, and competitive data—not guesswork.This shift has pushed SEO teams toward intelligent platforms that combine link building services, link building marketplaces, and SEO link building services into one streamlined workflow. Vefogix sits right at the center of this evolution.Link Building Services: Moving Beyond Random BacklinksLink building services are designed to help websites earn authoritative backlinks that improve search visibility. But modern SEO demands more than simple link placement.Outdated services often:Focus on quantity instead of relevanceHide publisher detailsProvide links without performance insightsToday’s link building services are strategy-driven, guided by competitor data and real-world results.How Vefogix Redefines Link Building ServicesVefogix applies AI to the entire link-building process:Identifies backlink sources already working for competitorsHighlights trusted, niche-relevant websitesEliminates risky or low-value domainsGives full transparency before you investThis...

-

AI Voice Agent: Redefining Business Communication in the Digital Age

An AI voice agent is rapidly becoming an essential tool for businesses that want to deliver faster, smarter, and more efficient customer interactions. As customer expectations shift toward instant responses and personalized experiences, AI voice agents offer a powerful way to automate conversations without sacrificing quality or professionalism.Unlike traditional call systems or IVR menus, an AI voice agent can understand natural speech, respond intelligently, and carry on real-time conversations that feel human-like. This technology is transforming how companies handle sales, support, and customer engagement.What Is an AI Voice Agent?An AI voice agent is an artificial intelligence–powered system designed to speak and listen like a human. It uses natural language processing, speech recognition, and machine learning to understand what a caller says and respond appropriately. Instead of relying on fixed scripts, AI voice agents adapt conversations based on context and user intent.These agents can answer incoming calls, make outbound calls, gather...

-

Dark Circles Treatment in Riyadh Fresh, Rested Eyes

Dark circles under the eyes can make even the healthiest face look tired and stressed. They often give the impression of fatigue, aging, or lack of sleep—regardless of how rested you actually feel. In a busy city like Riyadh, where long working hours, screen exposure, and environmental factors are common, under-eye darkness has become a frequent concern. Fortunately, modern dark circles treatment in Riyadh offers advanced solutions designed to restore fresh, rested-looking eyes safely and effectively.علاج الهالات السوداء في الرياضWhat Causes Dark Circles?Dark circles develop for various reasons, and identifying the cause is the key to successful treatment. Some of the most common factors include:Pigmentation: Excess melanin can cause brown or dark discoloration under the eyes.Thin Under-Eye Skin: The skin in this area is very delicate, allowing blood vessels to show through.Volume Loss: Aging or genetics can lead to hollowing under the eyes, creating shadows known as tear troughs.Lifestyle Factors:...

-

Nagaspin99 dan Strategi Menarik Pengguna

Nagaspin99 belakangan ini semakin sering dibicarakan oleh para penggemar game online di Indonesia. Nama ini muncul di berbagai forum, media sosial, hingga komunitas pecinta permainan digital. Banyak nagaspin99 daftar tertarik karena nagaspin99 dianggap menawarkan pengalaman bermain yang seru, praktis, dan mengikuti tren game online masa kini. Popularitas ini tidak datang begitu saja, melainkan hasil dari kombinasi fitur, kemudahan akses, serta minat pasar yang terus berkembang.Apa yang Membuat Nagaspin99 Berbeda?Salah satu alasan nagaspin99 cepat dikenal adalah karena konsepnya yang simpel namun tetap menarik. Pengguna tidak perlu proses rumit untuk memahami sistem permainan yang tersedia. Selain itu, nagaspin99 sering dikaitkan dengan variasi pilihan game yang beragam, sehingga pemain tidak mudah merasa bosan. Bagi banyak orang, kenyamanan dan variasi adalah faktor utama dalam memilih platform game online, dan hal inilah yang menjadi nilai tambah nagaspin99.Kemudahan Akses dan Tampilan yang User-FriendlyDi era digital, kemudahan akses menjadi hal yang sangat penting. Nagaspin99 dinilai mampu mengikuti...

-

.jpg)

Real Estate Seller Disclosure Services Boston: Ensuring Compliance and Confidence in Property Sales

In Massachusetts, selling real estate involves more than pricing and marketing a property. Understanding real estate seller disclosure services Boston is essential for sellers who want to complete transactions smoothly while minimizing legal risk. Although Massachusetts does not require a universal seller disclosure form, specific disclosure obligations still apply, making professional disclosure services a valuable part of the closing process.What Are Real Estate Seller Disclosure Services?Real estate seller disclosure services assist property owners in identifying, preparing, and delivering required and recommended disclosures during a real estate transaction. These services help sellers comply with state and federal regulations while ensuring buyers receive accurate and timely information about the property.Because disclosure laws in Massachusetts differ from many other states, sellers often rely on experienced professionals to navigate the process correctly and avoid costly errors.Massachusetts Disclosure Rules ExplainedMassachusetts follows a “buyer beware” legal framework, meaning buyers are responsible for conducting inspections and due...