Future-Ready Finance: E Invoicing in UAE for Compliance, Tax & Busines

The shift toward e invoicing in uae is transforming how businesses manage taxation, compliance, and financial reporting. As the government strengthens digital tax systems and transparency, organizations are adopting structured invoice formats, automated reporting, and regulatory-aligned billing processes. Companies operating across sectors are now exploring scalable solutions that connect accounting, tax filing, and compliance under one framework, ensuring accuracy and readiness for evolving mandates.

Businesses in the United Arab Emirates are aligning with regulatory expectations while modernizing finance operations. With the rise of digital reporting, integration with enterprise systems, and FTA-aligned documentation, e invoicing is becoming an essential component of UAE business regulations compliance and financial governance.

Understanding the Scope of UAE E-Invoicing

E invoicing refers to the digital generation, exchange, and storage of invoice data in structured formats approved by regulatory authorities. Unlike traditional PDFs, einvoice systems integrate directly with accounting platforms and tax frameworks. Organizations now combine e invoicing under gst principles with local compliance standards, ensuring real-time reporting and transparency across operations.

The transformation also impacts uae corporate tax services, reporting obligations, and documentation requirements such as transfer pricing documentation uae. Businesses are evaluating how automated billing, tax validation, and compliance workflows can strengthen operational efficiency while reducing errors.

Role of Compliance and Tax Alignment

With the expansion of corporate tax for smes in uae and stricter regulatory frameworks, companies are prioritizing uae tax compliance services and uae tax compliance solutions to avoid penalties. Integration of e invoice registration systems helps streamline reporting with authorities while aligning with uae corporate tax deadlines and regulatory documentation.

Organizations are increasingly working with a corporate tax advisor uae to ensure tax planning and strategy uae initiatives align with digital invoicing frameworks. This includes fta compliance services uae, corporate tax registration uae, and accurate documentation across business transactions.

Implementation Across Cities and Business Types

Major business hubs like Dubai and Abu Dhabi are witnessing rapid adoption of automated billing tools. Companies often consult a dubai e-invoicing consultant or opt for e-invoicing services abu dhabi to ensure proper deployment, system configuration, and compliance readiness.

Small enterprises are also entering the digital ecosystem through e-invoicing for small businesses uae, supported by cloud-based tools and advisory from corporate tax consultants in dubai. This enables startups and SMEs to integrate financial reporting, tax filing, and compliance in a cost-effective manner.

Technology and System Integration

Enterprises adopting uae e-invoicing solutions often integrate their systems with ERP tools like SAP to enable e invoicing in sap and sap e invoicing capabilities. This supports automation, audit trails, and seamless reporting for uae e-invoicing for b2b transactions.

Technology-driven workflows also enhance invoice validation, tax mapping, and analytics. Businesses rely on a uae e-invoicing solution provider to configure platforms that support scalability and regulatory alignment.

Timeline and Preparation Strategy

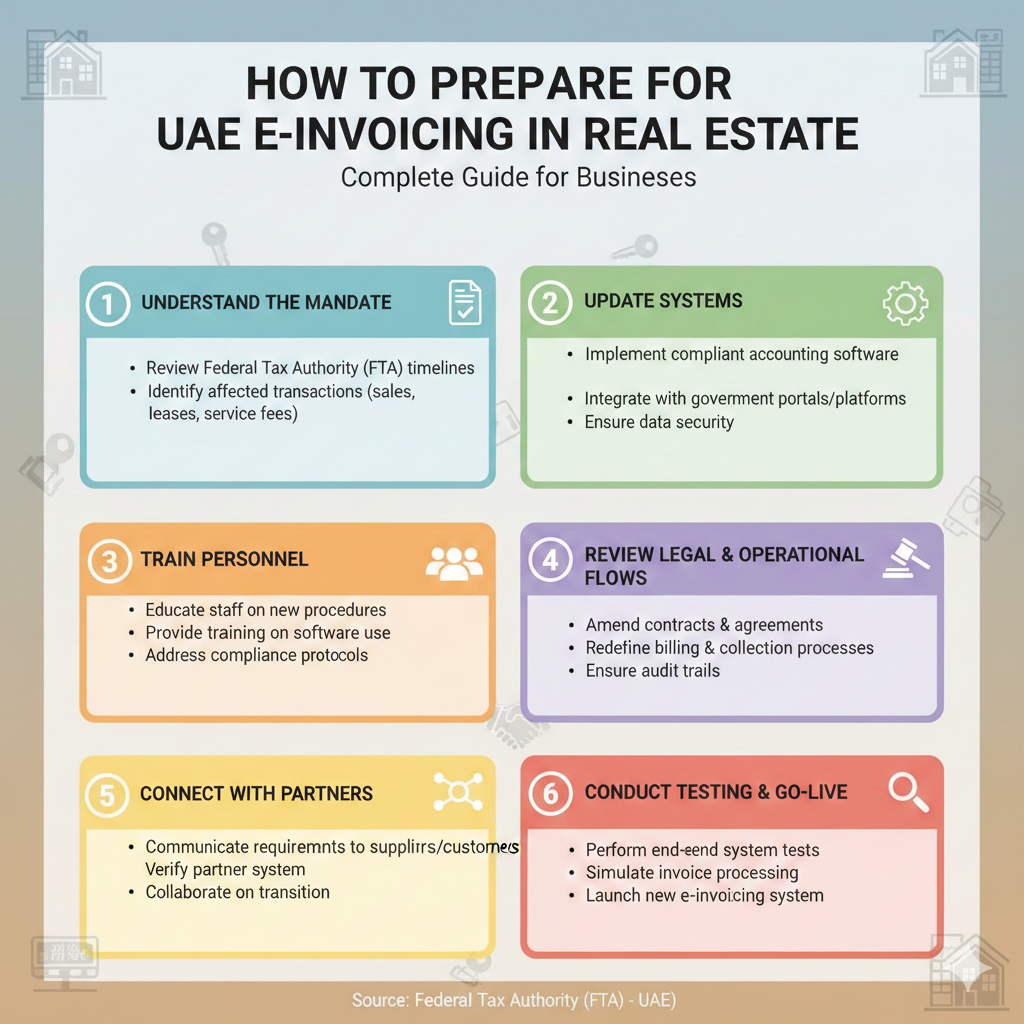

The e-invoicing implementation timeline uae is expected to roll out in phases, giving organizations time to upgrade accounting systems and compliance workflows. Companies focusing on how to prepare for uae e-invoicing are prioritizing system audits, digital documentation, staff training, and integration with tax modules.

Preparation also includes reviewing corporate tax consultants in dubai support structures, aligning reporting practices, and building structured invoice templates. Businesses that proactively adapt are better positioned for compliance and operational continuity.

Strategic Value Beyond Compliance

Beyond regulatory requirements, e invoicing strengthens financial visibility, improves cash flow management, and supports real-time analytics. Organizations adopting uae corporate tax services and compliance frameworks gain clarity over revenue tracking, tax liabilities, and financial planning.

Companies like AIS Business Corp Pvt Ltd support enterprises with advisory, deployment, and regulatory alignment across uae e-invoicing solutions, compliance strategies, and digital finance transformation. Their approach combines compliance readiness with operational efficiency to ensure long-term scalability.

E invoicing mandatory frameworks are not just regulatory obligations but opportunities to modernize finance ecosystems. Businesses that adopt structured systems, integrate tax reporting, and align with digital compliance models will gain operational efficiency and trust in the evolving UAE business environment.

FAQs on E Invoicing in UAE

What is the purpose of e invoicing in UAE?

E invoicing enables digital reporting, tax transparency, and compliance with regulatory frameworks while improving efficiency and reducing manual errors.

Is e invoicing mandatory for businesses in UAE?

Regulatory authorities are gradually moving toward e invoicing mandatory frameworks, especially for structured reporting and tax compliance.

How can SMEs adopt e invoicing systems?

SMEs can implement cloud-based tools, seek advisory support, and align financial systems with compliance requirements and corporate tax structures.

What industries will benefit most from e invoicing?

Retail, logistics, manufacturing, and professional services benefit significantly due to high transaction volumes and tax reporting needs.

How should businesses prepare for implementation?

Organizations should upgrade accounting systems, complete e invoice registration, ensure compliance readiness, and integrate digital reporting tools aligned with tax frameworks.

Comments

You must be logged in to comment.

Latest Articals

-

Picture Books for Kids: Carefully Selected Stories Designed to Inspire Learning, Curiosity, and Fun

Children’s literature plays a powerful role in shaping how young readers understand the world. Through colorful illustrations, gentle storytelling, and relatable characters, picture books for kids create early connections to reading, imagination, and emotional growth. These stories are often a child’s first introduction to learning beyond the classroom, making them an essential part of early childhood development.Felicia Whitford’s Barkley’s Adventures fits beautifully into this space. The book combines family warmth, playful exploration, and life lessons through the eyes of a lovable Labrador. It captures exactly what parents, educators, and caregivers look for when choosing meaningful picture books—stories that entertain while quietly teaching values like responsibility, curiosity, and kindness.Why Picture Books Matter in Early ChildhoodFrom a young age, children learn best through visual storytelling. Images paired with simple, engaging text help young readers build vocabulary, recognize emotions, and develop comprehension skills. Quality picture books encourage children to ask questions, make predictions, and connect...

-

Inclusive Children’s Picture Books Every Family Should Read in 2025

There’s a moment most families recognize: a child curled up close, waiting for the next page… and quietly deciding whether the story feels like them, or like someone they might someday understand. That’s the power behind inclusive children’s picture books. They don’t just entertain. They help kids practice belonging.In 2025, many families are looking for the best inclusive picture books not because inclusion is a trend, but because childhood is full of differences: different bodies, different brains, different cultures, different emotions, different ways of communicating. A truly inclusive bookshelf tells kids one simple thing again and again: there’s room for you here.And if there’s one story that captures that “room for you” feeling with warmth, humor, and bright kid-energy, it’s Coley Bear’s Blue-Tastic Day! It is a picture book that turns a very relatable mess into a very memorable lesson in acceptance and love.Why Inclusion in Children’s Books Isn’t Optional...

-

Business License For Online Business – Complete Business Permit Registration

Get your Business License And Registration done easily. Apply for an Online Business Permit, State Business License, or General Business License. Understand Business License Registration requirements, Business Operating License process, and check updated Business License Cost details.https://www.legalinfinix.com/how-to-get-food-license-for-cloud-kitchen-in-india/

-

Best Mystery Thriller Books: Top Picks to Spark Adventure, Suspense & Detective Curiosity

Mystery stories have a special kind of magic for young readers. They turn reading into a game: spot the clue, test a theory, and keep going “just one more chapter” until the truth clicks into place. When a book does that, it’s not only entertaining. It’s helping a child practice focus, patience, and problem-solving without feeling like homework.This guide highlights the best mystery thriller books for kids and teens, with one series taking the top spot for readers who love fast-paced twists, brave kid detectives, and just the right amount of suspense.Why Mystery and Thriller Stories Work So Well for KidsMany children who don’t like reading actually don’t like slow starts. They want a reason to care on page one. That’s where children’s mystery books work: they begin with a question (Who did it? What happened? What’s hiding in that house?) and invite the reader to chase answers alongside the characters.Curiosity...

-

The Science and Strategy Behind Sustainable Weight Loss

When it comes to improving overall health and confidence, weight loss remains one of the most discussed topics worldwide. While beauty treatments like nanoplastia hair treatment enhance your external appearance, achieving and maintaining a healthy weight works from within, transforming not just how you look but how you feel every day. Sustainable weight loss is not about crash diets or extreme exercise routines—it is about building long-term habits that support your body’s natural ability to burn fat, build strength, and maintain balance.Understanding What Weight Loss Really MeansWeight loss is the process of reducing total body mass, which may include fat, muscle, and water weight. However, healthy weight loss focuses specifically on reducing excess body fat while preserving lean muscle mass. The goal is not simply to see a lower number on the scale, but to improve overall health markers such as blood pressure, cholesterol levels, blood sugar balance, and energy...

-

Beard Hair Transplant in Riyadh Expert Grooming Clinics

A thick, well-defined beard has become a powerful statement of style and masculinity. Yet for many men, uneven growth, thin density, or patchy facial hair can make achieving the ideal look frustrating. Fortunately, expert grooming clinics in Riyadh now offer advanced beard hair transplant procedures designed to deliver natural, long-lasting results. With modern technology and skilled specialists, restoring facial hair has become safer, more precise, and more accessible than ever.زراعة شعر اللحية في الرياضWhat Is a Beard Hair Transplant?A beard hair transplant is a cosmetic procedure that restores or enhances facial hair by transferring healthy hair follicles from the scalp to the beard area. The donor hair is usually taken from the back or sides of the head, where hair is thicker and more resistant to thinning.Once implanted, these follicles adapt to their new location and begin growing naturally. Over time, the transplanted hair blends seamlessly with existing facial hair,...