Insurance Third Party Administrators Market by Type & Service 2025

Insurance Third Party Administrators Market Size & Forecast (2025–2033)

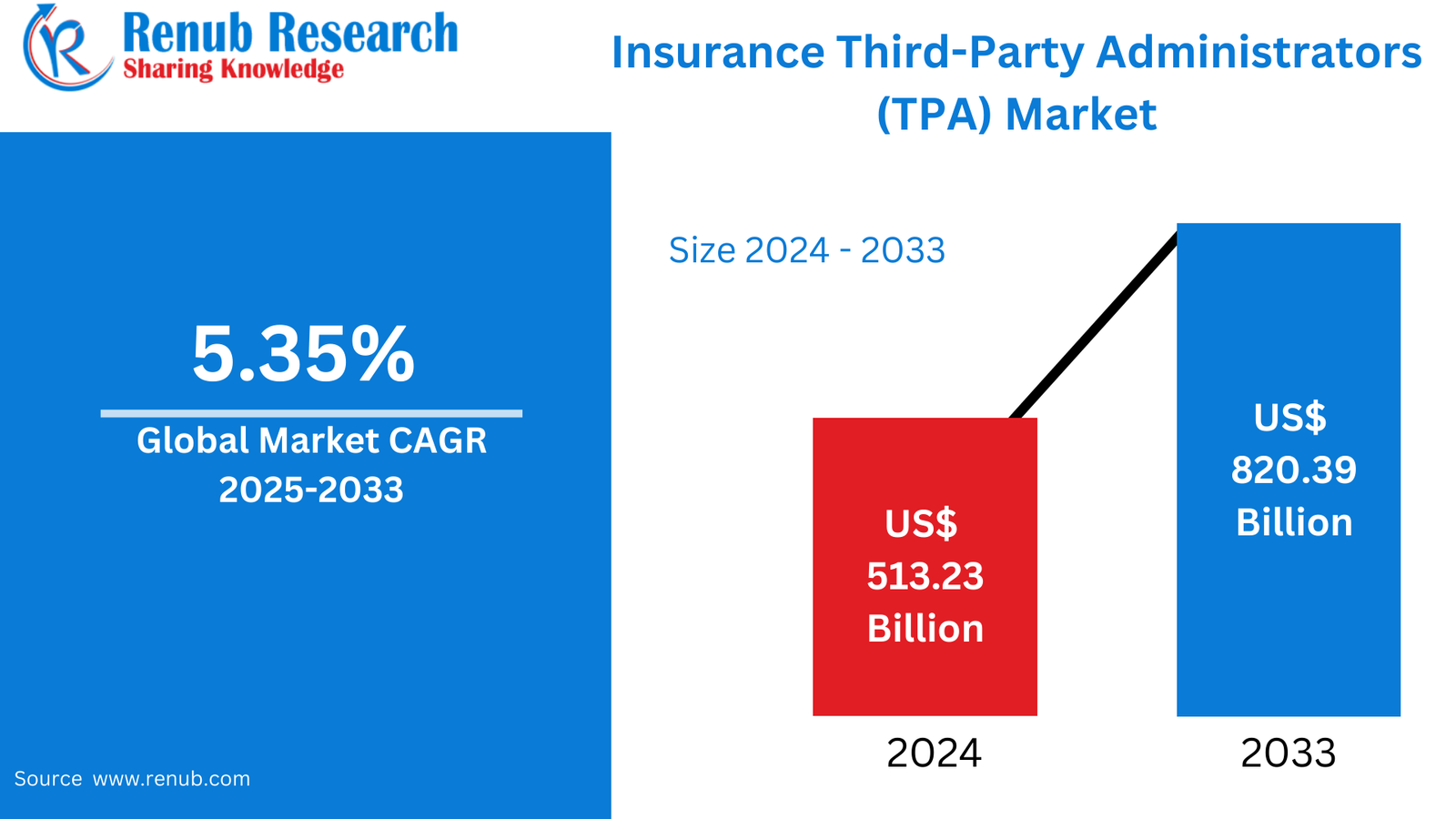

According To Renub Research Insurance Third Party Administrators (TPA) market is witnessing sustained expansion as insurers across the globe increasingly rely on specialized service providers to manage complex administrative functions. In 2024, the market was valued at approximately US$ 513.23 billion and is projected to reach US$ 820.39 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.35% from 2025 to 2033. This steady growth trajectory is driven by rising insurance penetration, increasing claim volumes, escalating healthcare costs, and the growing need for efficient, transparent, and technology-enabled policy administration.

Third Party Administrators act as critical intermediaries between insurers, policyholders, healthcare providers, repair networks, and regulatory authorities. By managing operationally intensive tasks, TPAs enable insurance companies to improve service delivery, reduce overhead costs, and focus on core competencies such as product innovation, underwriting, and market expansion.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=insurance-third-party-administrators-market-p.php

Insurance Third Party Administrators Market Outlook

Insurance Third Party Administrators are professional service organizations that manage administrative and operational insurance processes on behalf of insurance carriers and self-insured entities. Their responsibilities typically include claims processing, policy servicing, customer support, premium administration, compliance reporting, fraud detection, and coordination with service providers such as hospitals, garages, and surveyors.

The complexity of modern insurance products, combined with regulatory scrutiny and customer expectations for faster claim settlements, has significantly increased dependence on TPAs. As insurance ecosystems become more data-driven and customer-centric, TPAs play a vital role in ensuring accuracy, compliance, and operational efficiency throughout the insurance lifecycle.

Globally, demand for TPAs is particularly strong in countries with mature health, motor, and life insurance sectors. Markets such as North America, Europe, and parts of Asia-Pacific are witnessing rapid adoption due to rising claim frequency, digitization initiatives, and the growing need for scalable administrative support.

Key Growth Drivers in the Insurance Third Party Administrators Market

Rising Demand for Efficient Claims Management

The continuous increase in insurance claims across health, motor, commercial, and workers’ compensation segments is a major growth driver for the TPA market. Managing high claim volumes internally can be costly and time-consuming for insurers. TPAs streamline the claims lifecycle by ensuring accurate documentation, timely verification, efficient settlement, and transparent communication with policyholders.

Faster claim resolution improves customer satisfaction while reducing operational bottlenecks for insurers. As customer expectations continue to rise, insurers are increasingly partnering with TPAs to maintain service quality and brand reputation.

Growing Outsourcing of Insurance Administrative Services

Insurance companies are increasingly outsourcing non-core functions to TPAs to reduce fixed operational costs and improve scalability. Administrative activities such as policy issuance, billing, enrollment, customer communication, and compliance management require specialized expertise and advanced systems.

By outsourcing these functions, insurers gain access to experienced professionals, advanced analytics, and automation technologies without heavy capital investment. This trend is especially strong among mid-sized and rapidly expanding insurers seeking operational agility and cost efficiency.

Technological Advancements and Digital Transformation

Technology is transforming the TPA landscape. The adoption of artificial intelligence, cloud computing, automation, and data analytics has significantly enhanced the efficiency and accuracy of insurance administration. Digital platforms enable real-time data exchange, automated claims processing, predictive fraud detection, and improved reporting capabilities.

Cloud-based systems also allow TPAs to scale operations quickly, improve disaster recovery, and ensure data accessibility across geographies. Insurers increasingly favor TPAs with strong digital infrastructure, driving market growth in both developed and emerging economies.

Challenges in the Insurance Third Party Administrators Market

Regulatory Compliance and Data Privacy Risks

TPAs operate in a highly regulated environment and handle sensitive personal, medical, and financial data. Compliance with data protection laws and insurance regulations requires continuous investment in cybersecurity, compliance monitoring, and staff training.

Any lapse in compliance can result in legal penalties, reputational damage, and loss of client trust. The evolving nature of regulations across different regions adds complexity, particularly for TPAs operating internationally.

Intense Market Competition and Pricing Pressure

The global TPA market is highly competitive, with numerous regional and international service providers. This competition places downward pressure on pricing and profit margins. Smaller TPAs often struggle to compete with larger firms offering end-to-end digital solutions and global delivery capabilities.

To remain competitive, TPAs must continuously invest in innovation, service quality, and technology, which can strain financial resources and operational budgets.

Segment Analysis

Health Insurance Third Party Administrators Market

The health insurance segment dominates the TPA market due to rising healthcare costs, increasing insurance coverage, and complex medical claim processes. Health TPAs manage hospital networks, cashless treatments, claims adjudication, and fraud detection.

Growing hospitalization rates and expanding private and public health insurance programs continue to drive demand for specialized health insurance TPAs, particularly in countries with large populations and complex healthcare systems.

Motor Insurance Third Party Administrators Market

Motor insurance TPAs focus on accident claims processing, vehicle inspection coordination, repair network management, and settlement facilitation. They play a crucial role in reducing claim turnaround time and improving customer experience.

The increase in vehicle ownership, road accidents, and mandatory motor insurance regulations is fueling demand for motor insurance TPAs across both developed and emerging markets.

Claims Management Services Market

Claims management remains the core service offering within the TPA market. TPAs handle end-to-end claim workflows, from initial notification to final settlement. Efficient claims management reduces errors, ensures regulatory compliance, and improves insurer profitability.

As claims become more complex and data-intensive, insurers increasingly rely on TPAs for specialized claims expertise and technology-driven solutions.

End-User Analysis

Insurance Companies

Insurance companies represent the largest end-user segment. TPAs support insurers by managing policy administration, claims, customer service, fraud investigation, and data analytics. The rising number of insurers globally and the need for operational optimization continue to drive demand from this segment.

Large Enterprises and Self-Insured Employers

Large enterprises increasingly partner with TPAs to manage employee benefits, health plans, and workers’ compensation programs. TPAs offer scalable solutions, enterprise system integration, and advanced analytics that enable large organizations to control costs and improve service delivery.

Technology Analysis

Cloud-Based Platforms

Cloud-based TPAs are gaining rapid adoption due to their flexibility, scalability, and cost efficiency. Cloud platforms support real-time processing, automation, and remote accessibility while reducing infrastructure costs.

As insurers prioritize digital transformation and cybersecurity, cloud-enabled TPAs are becoming a preferred choice in the global market.

Regional Analysis

United States

The United States remains the largest market for insurance TPAs, supported by a highly developed insurance ecosystem, high healthcare expenditure, and strong regulatory oversight. TPAs play a critical role in managing health and motor insurance claims, fraud detection, and compliance reporting.

The trend toward outsourcing administrative services and adopting AI-driven platforms continues to fuel market growth in the country.

Germany

Germany’s TPA market benefits from a strong health and motor insurance framework and strict regulatory standards. TPAs support insurers by ensuring compliance, efficient claims handling, and secure data management.

Rising healthcare costs and increasing policy complexity are driving insurers to rely more heavily on professional administrators.

China

China represents one of the fastest-growing TPA markets due to expanding insurance coverage, government support for insurance adoption, and rapid digitalization. TPAs play a key role in claims management, fraud prevention, and coordination with hospitals and service providers.

The integration of digital health platforms and insurance technology is further accelerating market growth.

Saudi Arabia

Saudi Arabia’s TPA market is driven by mandatory health insurance regulations, growing motor insurance demand, and national digital transformation initiatives. TPAs help insurers comply with regulatory requirements while improving claims efficiency and service transparency.

Investments in healthcare infrastructure and digital platforms continue to create opportunities for advanced TPA solutions in the region.

Market Segmentation Overview

By Insurance Type

· Health Insurance

· Retirement and Pension

· Commercial General Liability

· Motor Insurance

· Workers’ Compensation

· Travel Insurance

By Service Type

· Claims Management

· Policy Administration

· Billing and Enrollment

· Provider Network Management

· Risk and Compliance Services

By End User

· Insurance Companies

· Self-Insured Employers

· Government Health Schemes

· Brokers and Reinsurers

By Enterprise Size

· Large Enterprises

· Small and Medium Enterprises

By Technology

· Cloud-Based Platforms

· On-Premise Solutions

· AI-Enabled TPAs

· Blockchain-Enabled TPAs

By Region

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East and Africa

Competitive Landscape and Key Players

The global Insurance Third Party Administrators market is moderately fragmented, with established multinational firms and regional players competing on service quality, technology adoption, and geographic reach. Key players focus on expanding digital capabilities, enhancing analytics, and strengthening regulatory compliance frameworks.

Companies are evaluated across multiple dimensions, including market overview, leadership strength, recent developments, SWOT analysis, and revenue performance. Continuous innovation, strategic partnerships, and technology investment remain critical to sustaining competitive advantage in this evolving market.

Conclusion

The Insurance Third Party Administrators market is positioned for steady long-term growth as insurers increasingly seek efficiency, scalability, and digital excellence. Rising claim volumes, healthcare costs, and regulatory complexity make TPAs indispensable partners in the modern insurance ecosystem.

With advancements in cloud computing, artificial intelligence, and automation, TPAs are evolving from back-office administrators to strategic enablers of insurer performance. As global insurance markets expand and customer expectations rise, the role of Third Party Administrators will continue to grow in importance through 2033 and beyond.

Comments

You must be logged in to comment.

Latest Articals

-

Your Go-To Commercial & Residential Plumbing Experts in Conyers – tksons

Plumbing is one of those essential systems that often goes unnoticed—until something goes wrong. From unexpected leaks to major system failures, plumbing issues can disrupt both homes and businesses in an instant. That’s why having experienced commercial plumbing contractors in Conyers and dependable residential plumbing services in Conyers is crucial. tksons has become a trusted name in the Conyers area by delivering reliable, efficient, and long-lasting plumbing solutions for every type of property.Comprehensive Commercial Plumbing Services in ConyersCommercial plumbing requires precision, experience, and a deep understanding of complex systems. Businesses depend on properly functioning plumbing to maintain hygiene, safety, and daily operations. As leading commercial plumbing contractors in Conyers, tksons provides tailored plumbing services for offices, retail stores, restaurants, apartment complexes, and industrial facilities.Our commercial services include pipe installation and repair, water supply line management, drainage and sewer services, restroom plumbing, and preventive maintenance programs. We understand that downtime can be costly, so our team works efficiently...

-

Expert Electrician in Buckhead Offering Safe & Modern Electrical Solutions | mccelec

Electrical systems play a crucial role in keeping homes and businesses safe, functional, and efficient. From powering daily activities to supporting advanced technology, reliable electrical work is essential. If you’re searching for professional electrical services in Buckhead, mccelec is your trusted local choice, delivering dependable solutions backed by experience, safety, and quality workmanship.The Importance of Hiring a Qualified Electrician in BuckheadElectrical issues are not just inconvenient—they can be dangerous if handled improperly. Faulty wiring, overloaded circuits, or outdated panels can increase the risk of fires, power failures, and equipment damage. Hiring a certified electrician Buckhead property owners trust ensures that every job is completed according to safety standards and local electrical codes.With mccelec, you get skilled electricians who understand the complexities of modern electrical systems and provide solutions that are both effective and long-lasting.Complete Residential Electrical Services in BuckheadYour home’s electrical system should be safe, reliable, and designed to meet your lifestyle needs. mccelec offers comprehensive...

-

Best Computer Academy in Jaipur – Learn Skills That Build Your Career

In today’s digital world, computer education is no longer optional—it is a necessity. Whether you are a student, job seeker, or working professional, learning the right computer skills can open many doors. Jaipur has become a growing hub for quality education, and choosing the right institute can make a big difference in your future.If you are searching for the best computer academy in Jaipur, best training center in Jaipur, or best coaching institute in Jaipur, this blog will guide you clearly and honestly.Best Computer Academy in JaipurWhen students search for the Best Computer Academy in Jaipur, they look for quality education, practical training, and career support. A good computer academy should focus on real-world skills, updated courses, and experienced trainers.GPS Computer Academy, Jaipur stands out because it offers AI-Powered Education and Training designed for today’s competitive world. The academy focuses on helping students understand concepts easily and apply them practically....

-

.jpeg)

Adult Orthodontic Options for Healthier, Aligned Smiles in Sea Girt, NJ

Adult orthodontic treatment has become an increasingly popular choice for improving both dental health and appearance. At Your Dentalist in Sea Girt, NJ, adults have access to modern orthodontic options designed for comfort, discretion, and efficiency. Straighter teeth are not only about aesthetics but also about maintaining long-term oral health.Many adults seek orthodontic care to correct shifting teeth, bite problems, or alignment concerns that were never treated earlier. With today’s advanced solutions, achieving a healthy, aligned smile is more accessible than ever. Why Adults Choose Orthodontic TreatmentAdult orthodontic care addresses issues that can affect daily comfort and dental health. Misaligned teeth may contribute to uneven wear, jaw discomfort, and difficulty cleaning certain areas. Orthodontic treatment helps correct these problems and supports overall oral function.Beyond health benefits, orthodontic care enhances confidence. A well-aligned smile often improves personal and professional interactions. Common Orthodontic Concerns in AdultsAdult patients often experience dental changes over...

-

How AI-Powered Link Building Is Replacing Traditional SEO Outreach

For years, link building meant endless emails, uncertain replies, and backlinks that didn’t always improve rankings. In 2026, that model is breaking fast. Businesses now want clarity, control, and competitive data—not guesswork.This shift has pushed SEO teams toward intelligent platforms that combine link building services, link building marketplaces, and SEO link building services into one streamlined workflow. Vefogix sits right at the center of this evolution.Link Building Services: Moving Beyond Random BacklinksLink building services are designed to help websites earn authoritative backlinks that improve search visibility. But modern SEO demands more than simple link placement.Outdated services often:Focus on quantity instead of relevanceHide publisher detailsProvide links without performance insightsToday’s link building services are strategy-driven, guided by competitor data and real-world results.How Vefogix Redefines Link Building ServicesVefogix applies AI to the entire link-building process:Identifies backlink sources already working for competitorsHighlights trusted, niche-relevant websitesEliminates risky or low-value domainsGives full transparency before you investThis...

-

AI Voice Agent: Redefining Business Communication in the Digital Age

An AI voice agent is rapidly becoming an essential tool for businesses that want to deliver faster, smarter, and more efficient customer interactions. As customer expectations shift toward instant responses and personalized experiences, AI voice agents offer a powerful way to automate conversations without sacrificing quality or professionalism.Unlike traditional call systems or IVR menus, an AI voice agent can understand natural speech, respond intelligently, and carry on real-time conversations that feel human-like. This technology is transforming how companies handle sales, support, and customer engagement.What Is an AI Voice Agent?An AI voice agent is an artificial intelligence–powered system designed to speak and listen like a human. It uses natural language processing, speech recognition, and machine learning to understand what a caller says and respond appropriately. Instead of relying on fixed scripts, AI voice agents adapt conversations based on context and user intent.These agents can answer incoming calls, make outbound calls, gather...