Europe Insurance TPA Market Analysis by Insurance & Service Type 2026–

Europe Insurance Third Party Administrators Market Size and Forecast 2026–2034

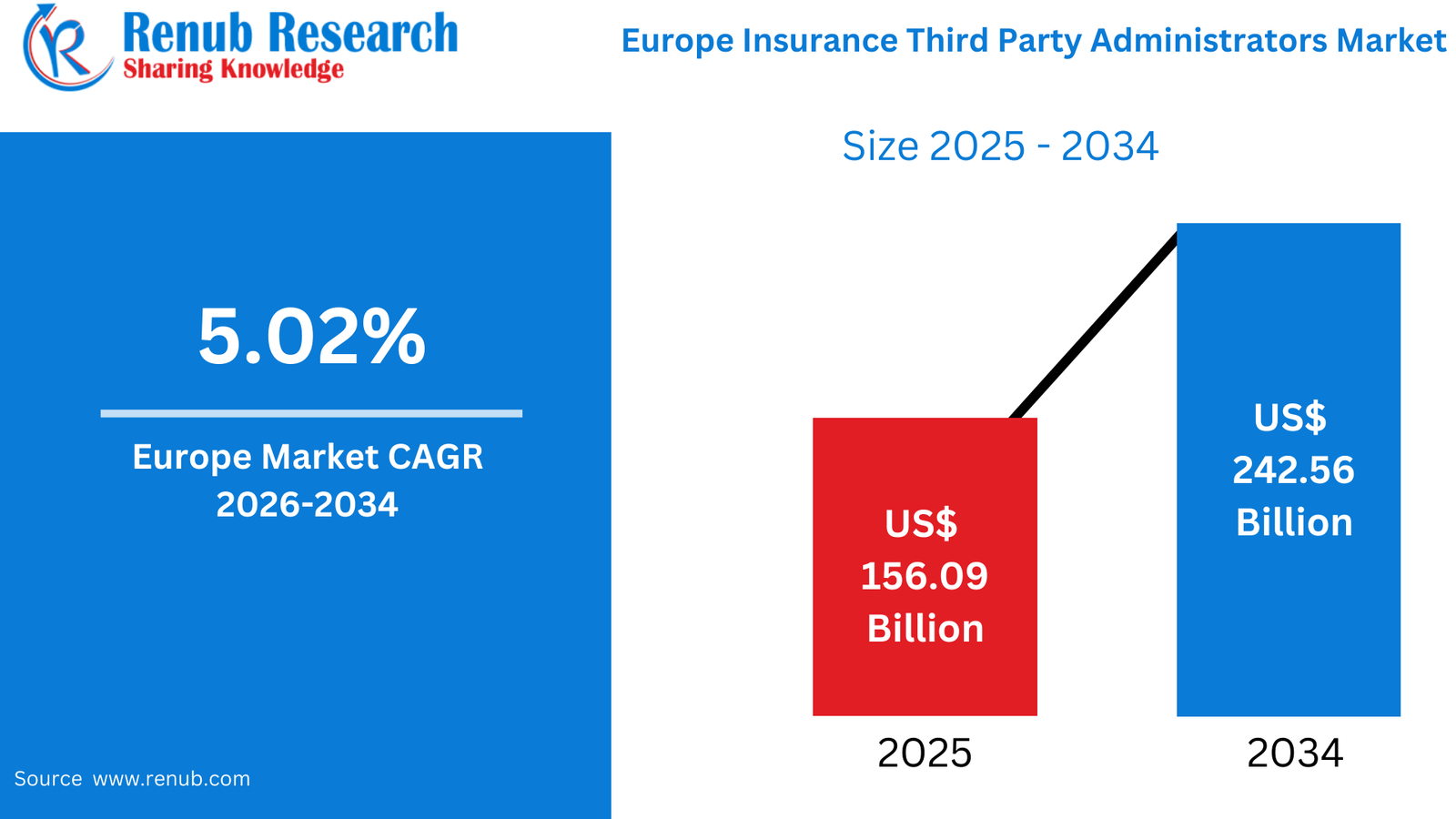

According to Renub Research Europe Insurance Third Party Administrators (TPA) market is poised for consistent growth over the forecast period from 2026 to 2034, driven by rising outsourcing trends among insurers and the rapid digital transformation of insurance operations. The market is projected to expand from approximately US$ 156.09 billion in 2025 to nearly US$ 242.56 billion by 2034, registering a compound annual growth rate (CAGR) of about 5.02%. This growth reflects the increasing reliance of insurance companies on TPAs to manage claims processing, policy administration, billing, enrollment, and customer support in a cost-efficient and scalable manner. As European insurers face mounting regulatory complexity, competitive pressure from insurtech firms, and rising customer expectations, TPAs are emerging as essential enablers of operational efficiency and service quality.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-insurance-third-party-administrators-market-p.php

Europe Insurance Third Party Administrators Market Outlook

Insurance Third Party Administrators are specialized service providers that manage a range of administrative and operational functions on behalf of insurance companies. These functions typically include claims processing, policy administration, enrollment management, billing, customer service, fraud detection, compliance support, and data management. By delegating these non-core but critical tasks to TPAs, insurers can reduce operating costs, improve turnaround times, and focus more intensively on underwriting, product innovation, and distribution strategies.

In Europe, the adoption of TPAs has accelerated as insurers confront increased operational complexity, cross-border insurance activities, and diverse regulatory requirements. TPAs leverage advanced digital platforms, automation tools, analytics, and standardized workflows to deliver faster, more transparent, and more accurate services. Their ability to scale operations and offer specialized expertise has become particularly valuable in health insurance, motor insurance, travel insurance, and corporate risk programs. As cloud computing, artificial intelligence, and data-driven decision-making become integral to insurance operations, TPAs are solidifying their position as long-term strategic partners within the European insurance ecosystem.

Growth Drivers of the Europe Insurance Third Party Administrators Market

A major driver of growth in the Europe TPA market is the increasing pressure on insurers to outsource non-core operations. Traditional insurers are facing intense competition from agile insurtechs and digital-first players that operate with lower cost structures and faster innovation cycles. Outsourcing claims processing, policy servicing, and customer support to TPAs allows insurers to enhance operational agility while controlling administrative expenses. TPAs provide scalable platforms, skilled personnel, and domain expertise that are often costly or time-consuming for insurers to develop internally.

Another important growth driver is the rising penetration of insurance products across Europe, including health, motor, travel, and specialty lines. As insurance coverage expands, transaction volumes increase, making efficient administration critical. TPAs help insurers manage this growth without proportionate increases in internal headcount. Strategic partnerships, such as collaborations involving Wakam UK Ltd. and infrastructure platforms like Vitesse, highlight how TPAs and technology providers are reshaping claims fund management and operational efficiency across the region.

Regulatory Complexity and Compliance Requirements

Europe’s insurance sector operates under a dense regulatory framework at both national and European Union levels. Regulations related to solvency, consumer protection, data privacy, and conduct standards impose significant compliance burdens on insurers. Managing these obligations across multiple jurisdictions is resource-intensive and carries substantial risk if not handled correctly. TPAs have positioned themselves as compliance specialists, maintaining up-to-date knowledge of local regulations, reporting requirements, and documentation standards.

TPAs play a crucial role in helping insurers comply with data protection regulations such as GDPR, as well as anti-fraud and fair-claims practices. The introduction of frameworks such as the Digital Operational Resilience Act (DORA) further underscores the importance of robust ICT risk management across insurance operations and third-party service providers. By outsourcing to TPAs with established compliance capabilities, insurers can reduce regulatory risk, avoid penalties, and ensure consistent operational practices across markets.

Digital Transformation and Data-Driven Insurance Operations

Digital transformation is one of the most powerful forces shaping the Europe Insurance TPA market. Insurers are under increasing pressure to digitize the entire policy lifecycle, from onboarding and underwriting to claims settlement and renewals. Many TPAs have invested heavily in cloud-based platforms, application programming interfaces (APIs), automation tools, and advanced analytics to meet these demands. As a result, they can often deliver digital capabilities more rapidly than traditional insurers.

Artificial intelligence is being used by TPAs for fraud detection, automated claims triage, document processing, and predictive analytics. These technologies improve accuracy, reduce cycle times, and enhance customer experience. TPAs also benefit from aggregating data across multiple insurer clients, enabling benchmarking and performance optimization. Digital-first initiatives, such as collaborations between brokers and insurers like McGill and Partners and AEGIS London, demonstrate how automation and analytics are redefining insurance workflows across Europe.

Challenges in the Europe Insurance Third Party Administrators Market

Despite strong growth prospects, the Europe TPA market faces notable challenges, particularly related to margin pressure and price-based competition. Many insurers continue to view TPAs primarily as cost-saving vendors rather than strategic partners, leading to aggressive pricing negotiations. Contracts are often structured around cost-per-transaction or per-policy metrics, limiting opportunities for premium pricing based on value-added services.

At the same time, TPAs must continually invest in technology, cybersecurity, compliance, and skilled talent to remain competitive. These rising fixed costs can strain profitability, especially for mid-sized and smaller TPAs that lack the scale efficiencies of larger players. Revenue concentration risk is another concern, as reliance on a small number of large insurer clients can expose TPAs to contract renegotiation or termination risks.

Data Security, Trust, and Reputational Risk

Data security and trust are critical issues in the Europe Insurance TPA market. TPAs handle highly sensitive personal and financial data related to health, motor, travel, and liability insurance. Any data breach, mishandling of information, or failure to comply with GDPR can result in severe reputational damage and financial penalties. As a result, insurers are increasingly cautious about outsourcing to TPAs without robust security frameworks.

To maintain trust, TPAs must invest heavily in cybersecurity measures, including encryption, access controls, incident response planning, and regular audits. The use of advanced analytics and automation in claims decision-making also raises concerns around transparency and fairness. Building and maintaining trust with insurers, regulators, and policyholders remains an ongoing challenge that directly influences long-term success in the European market.

Europe Health Insurance Third Party Administrators Market

The health insurance TPA segment is one of the most dynamic and complex in Europe. TPAs manage pre-authorizations, claims adjudication, provider networks, wellness programs, and customer service for health insurers and employer-sponsored schemes. Europe’s diverse healthcare systems, ranging from state-led models to private insurance-dominated markets, create strong demand for TPAs with deep local expertise.

Health insurance TPAs also play a key role in managing medical cost inflation, detecting fraud and abuse, and negotiating provider tariffs. They support insurers in offering value-added services such as telemedicine, disease management, and wellness incentives. With aging populations and rising prevalence of chronic diseases across Europe, health insurers increasingly rely on TPAs to optimize utilization and enhance member engagement.

Europe Motor Insurance Third Party Administrators Market

Motor insurance TPAs in Europe support insurers with claims handling, roadside assistance coordination, repair network management, and replacement vehicle services. The region’s high vehicle density, diverse driving conditions, and frequent cross-border travel create complex claims scenarios. TPAs with strong partner networks can significantly reduce claims cycle times and operational costs.

Digital innovations such as photo-based damage assessments, telematics integration, and automated first-notice-of-loss systems are becoming standard offerings. As connected vehicles and usage-based insurance models gain traction, TPAs are expected to play a growing role in managing data-driven claims and accident management services across Europe.

Europe Travel Insurance Third Party Administrators Market

Travel insurance TPAs specialize in emergency assistance, medical repatriation, claims processing, and 24/7 customer support for travelers. Europe’s status as a major source and destination for international travel makes TPAs indispensable to travel insurers. They maintain global networks of medical providers, evacuation partners, and logistics coordinators to manage emergencies efficiently.

Volatility caused by pandemics, geopolitical tensions, and natural disasters has increased the complexity of travel insurance operations. TPAs help insurers adapt quickly by handling surges in claims, updating policy conditions, and coordinating with local authorities. Their ability to manage cross-border claims and provide multilingual support enhances customer confidence and insurer resilience.

Insurance Third Party Claims Management Market in Europe

Claims management remains the core function for most European TPAs. End-to-end claims handling includes notification, triage, investigation, documentation, and settlement. Efficient claims management focuses on reducing cycle times, improving accuracy, and delivering a positive policyholder experience.

TPAs deploy digital portals, automation, and analytics to detect fraud, prioritize cases, and allocate resources effectively. Claims data generated by TPAs also supports insurers in refining underwriting models and developing new products. However, performance is closely monitored through service-level agreements, making operational excellence a critical success factor.

Europe Insurance Third Party Billing and Enrollment Market

Billing and enrollment services are particularly important in group health insurance, employee benefits, and corporate insurance programs. TPAs manage policy issuance, premium collection, eligibility management, and account maintenance while integrating with payroll and HR systems. Outsourcing these functions reduces administrative errors and improves participant experience.

As digital onboarding, e-signatures, and real-time eligibility checks become standard, TPAs compete on the usability of their platforms and integration capabilities. In multi-country benefit programs, TPAs provide consolidated administration and reporting, helping organizations maintain compliance and cost control across diverse European jurisdictions.

Europe Insurance Third Party Administrators Companies Market

The European TPA landscape includes large multinational providers, regional specialists, and niche players focused on specific insurance lines. Large TPAs offer end-to-end solutions encompassing claims, billing, enrollment, and customer service, while smaller firms specialize in high-complexity or high-touch segments. Competition increasingly centers on technology capabilities, regulatory expertise, and integration flexibility rather than purely on price.

Key companies operating in the market include Charles Taylor Plc., Crawford & Company, Gallagher Bassett Services Inc., Sedgwick Claims Management Services, and ExlService Holdings Inc.. These players compete through innovation, strategic partnerships, and regional expansion to strengthen their market positions.

Country-Level Outlook of the Europe Insurance Third Party Administrators Market

Germany’s TPA market is shaped by strict regulation, a strong focus on documentation, and high expectations for process reliability. TPAs support insurers in health, motor, and accident insurance while ensuring compliance with rigorous consumer protection standards. Digitalization initiatives, including e-health and electronic claims, continue to drive demand for advanced TPA services.

The United Kingdom represents one of the most mature TPA markets in Europe, supported by a sophisticated insurance sector and the presence of global and Lloyd’s market participants. TPAs in the UK are increasingly viewed as strategic partners in digital transformation, delivering self-service portals, straight-through processing, and integrated customer communication. Continued investment, such as expansions by international assistance providers into London, underscores the UK’s role as a hub for insurance administration services.

Europe Insurance Third Party Administrators Market Segmentation Overview

The Europe Insurance TPA market is segmented by insurance type, service type, end user, enterprise size, technology, and geography. Major insurance types include health, motor, travel, commercial liability, and retirement products. Service types range from claims management and policy administration to billing, enrollment, and risk compliance services. End users include insurance companies, self-insured employers, government health schemes, and brokers. Technology segmentation highlights the growing importance of cloud-based and AI-enabled platforms. Together, these segments illustrate the broad and expanding role of TPAs within Europe’s evolving insurance landscape.

Comments

You must be logged in to comment.

Latest Articals

-

Why Mental Health Support Is Essential for Long-Term Wellness

Long-term wellness is not only about physical fitness or the absence of illness; it also depends heavily on emotional stability and psychological balance. In today’s fast-paced world, people face constant pressures from work, relationships, finances, and social expectations. Without proper support, these pressures can slowly affect emotional health. Access to Mental Health Resources plays a vital role in helping individuals manage challenges, maintain balance, and build a healthier future.Understanding Emotional Well-Being and Its ImportanceEmotional well-being influences how people think, feel, and respond to everyday situations. When mental health is neglected, even small problems can feel overwhelming. Over time, unmanaged stress and emotional strain may lead to anxiety, burnout, or persistent low mood. Recognizing emotional needs early allows individuals to take proactive steps before issues become deeply rooted.Support systems focused on mental health help people understand their emotions, develop self-awareness, and respond to life’s challenges more effectively. These systems are not...

-

Your Go-To Commercial & Residential Plumbing Experts in Conyers – tksons

Plumbing is one of those essential systems that often goes unnoticed—until something goes wrong. From unexpected leaks to major system failures, plumbing issues can disrupt both homes and businesses in an instant. That’s why having experienced commercial plumbing contractors in Conyers and dependable residential plumbing services in Conyers is crucial. tksons has become a trusted name in the Conyers area by delivering reliable, efficient, and long-lasting plumbing solutions for every type of property.Comprehensive Commercial Plumbing Services in ConyersCommercial plumbing requires precision, experience, and a deep understanding of complex systems. Businesses depend on properly functioning plumbing to maintain hygiene, safety, and daily operations. As leading commercial plumbing contractors in Conyers, tksons provides tailored plumbing services for offices, retail stores, restaurants, apartment complexes, and industrial facilities.Our commercial services include pipe installation and repair, water supply line management, drainage and sewer services, restroom plumbing, and preventive maintenance programs. We understand that downtime can be costly, so our team works efficiently...

-

Expert Electrician in Buckhead Offering Safe & Modern Electrical Solutions | mccelec

Electrical systems play a crucial role in keeping homes and businesses safe, functional, and efficient. From powering daily activities to supporting advanced technology, reliable electrical work is essential. If you’re searching for professional electrical services in Buckhead, mccelec is your trusted local choice, delivering dependable solutions backed by experience, safety, and quality workmanship.The Importance of Hiring a Qualified Electrician in BuckheadElectrical issues are not just inconvenient—they can be dangerous if handled improperly. Faulty wiring, overloaded circuits, or outdated panels can increase the risk of fires, power failures, and equipment damage. Hiring a certified electrician Buckhead property owners trust ensures that every job is completed according to safety standards and local electrical codes.With mccelec, you get skilled electricians who understand the complexities of modern electrical systems and provide solutions that are both effective and long-lasting.Complete Residential Electrical Services in BuckheadYour home’s electrical system should be safe, reliable, and designed to meet your lifestyle needs. mccelec offers comprehensive...

-

Best Computer Academy in Jaipur – Learn Skills That Build Your Career

In today’s digital world, computer education is no longer optional—it is a necessity. Whether you are a student, job seeker, or working professional, learning the right computer skills can open many doors. Jaipur has become a growing hub for quality education, and choosing the right institute can make a big difference in your future.If you are searching for the best computer academy in Jaipur, best training center in Jaipur, or best coaching institute in Jaipur, this blog will guide you clearly and honestly.Best Computer Academy in JaipurWhen students search for the Best Computer Academy in Jaipur, they look for quality education, practical training, and career support. A good computer academy should focus on real-world skills, updated courses, and experienced trainers.GPS Computer Academy, Jaipur stands out because it offers AI-Powered Education and Training designed for today’s competitive world. The academy focuses on helping students understand concepts easily and apply them practically....

-

.jpeg)

Adult Orthodontic Options for Healthier, Aligned Smiles in Sea Girt, NJ

Adult orthodontic treatment has become an increasingly popular choice for improving both dental health and appearance. At Your Dentalist in Sea Girt, NJ, adults have access to modern orthodontic options designed for comfort, discretion, and efficiency. Straighter teeth are not only about aesthetics but also about maintaining long-term oral health.Many adults seek orthodontic care to correct shifting teeth, bite problems, or alignment concerns that were never treated earlier. With today’s advanced solutions, achieving a healthy, aligned smile is more accessible than ever. Why Adults Choose Orthodontic TreatmentAdult orthodontic care addresses issues that can affect daily comfort and dental health. Misaligned teeth may contribute to uneven wear, jaw discomfort, and difficulty cleaning certain areas. Orthodontic treatment helps correct these problems and supports overall oral function.Beyond health benefits, orthodontic care enhances confidence. A well-aligned smile often improves personal and professional interactions. Common Orthodontic Concerns in AdultsAdult patients often experience dental changes over...

-

How AI-Powered Link Building Is Replacing Traditional SEO Outreach

For years, link building meant endless emails, uncertain replies, and backlinks that didn’t always improve rankings. In 2026, that model is breaking fast. Businesses now want clarity, control, and competitive data—not guesswork.This shift has pushed SEO teams toward intelligent platforms that combine link building services, link building marketplaces, and SEO link building services into one streamlined workflow. Vefogix sits right at the center of this evolution.Link Building Services: Moving Beyond Random BacklinksLink building services are designed to help websites earn authoritative backlinks that improve search visibility. But modern SEO demands more than simple link placement.Outdated services often:Focus on quantity instead of relevanceHide publisher detailsProvide links without performance insightsToday’s link building services are strategy-driven, guided by competitor data and real-world results.How Vefogix Redefines Link Building ServicesVefogix applies AI to the entire link-building process:Identifies backlink sources already working for competitorsHighlights trusted, niche-relevant websitesEliminates risky or low-value domainsGives full transparency before you investThis...